Tesla (TSLA) sales are currently crashing in China, based on both new monthly and weekly data released today.

That’s despite the new Model Y, record discounts, and incentives. Competition and a new electric vehicle (EV) price war are putting significant pressure on Tesla in China.

Tesla experienced a slow first quarter globally, including in China, but the automaker attributed this to the Model Y design changeover, which reduced production throughout the quarter.

The company doesn’t have this problem in Q2, and in fact, it benefits from pent-up demand for the new version of its best-selling car from the first quarter.

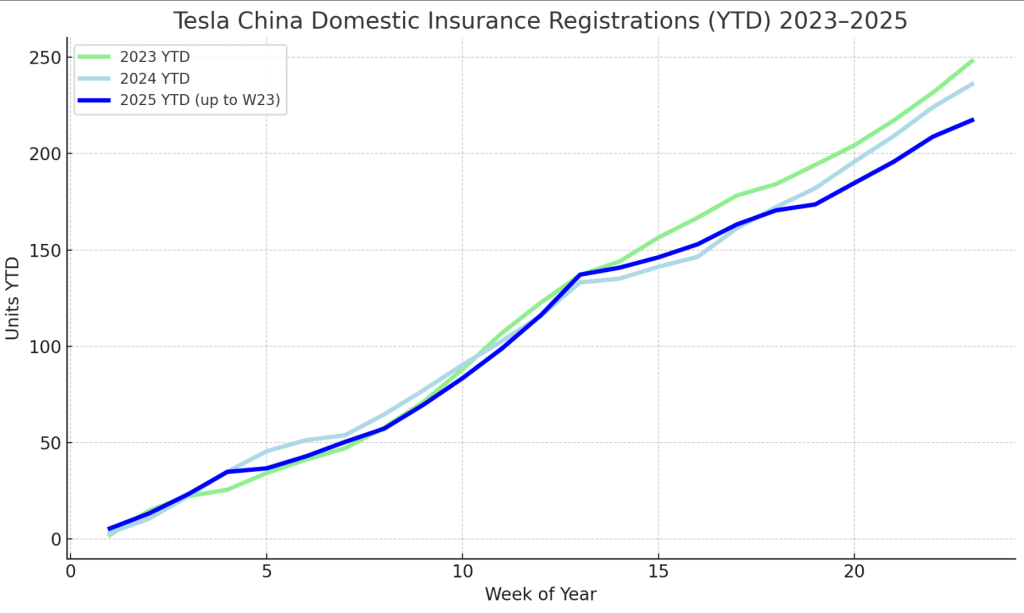

Yet, the data now suggests that Tesla performed worse in Q2 than in Q1 in China, and it’s also underperforming significantly compared to the same period last year.

New insurance registration data from China were released today, confirming that Tesla sold only 8,600 vehicles in China during the first week of June.

It’s way below expectations and a drop of more than 4,000 units compared to the previous week, despite Tesla generally ramping up domestic deliveries during the last month of the quarter.

Tesla’s deliveries in 2025 are now lagging 2024 by about 20,000 units:

These lower sales are coming despite Tesla having higher discounts on its lineup than during the same period last year, including 0% interest loans.

May retail and export data were also released, confirming that Tesla delivered 38,588 vehicles in China and exported 23,074 cars from China in May.

In total, that’s 61,662 units, which is below the same period last year. Tesla’s wholesale deliveries in and from China have been down each month of 2025:

Tesla’s lower performance in 2025 is especially concerning amid electric vehicle sales surging in China. They were up 35% in the first quarter and the trend is continuing in the second quarter.

Competition is stealing sales from Tesla, and things are expected to get worse as BYD just triggered a new EV price war in China with significant new price drops.

Electrek’s Take

This data is clear: Tesla is facing a demand collapse in China. The company sat on its lead for too long and bet everything on autonomous driving.

Now, it has a limited and stale vehicle lineup that the competition is either surpassing or undercutting in price.

Top comment by Grant

In the US and Europe it was Musk’s behavior that started the demise. In China Elon stopped paying attention to the market. A leader would have been working to save the company, instead of playing politics.

This has been the case for the past two years in China, where the competition is the strongest, but Tesla has countered by reducing prices and offering interest-free loans.

The result is that Tesla’s gross margins on vehicles sold in China (almost entirely RWD Model 3 and Model Y vehicles) are practically nonexistent.

Tesla can’t afford to lower prices much more without starting to lose money.

With BYD starting a new price war and targeted competition coming from the Xiaomi YU7, the second half of the year could prove very difficult for Tesla in China.

FTC: We use income earning auto affiliate links. More.

Comments