Trump’s US Commerce Secretary, Howard Lutnick, who indirectly owns Tesla (TSLA) stocks through his firm, has publicly recommended buying Tesla stocks today.

This is likely the first time that a sitting US Commerce Secretary publicly recommends to buy a specific stock.

The circumstances in which this first is happening are genuinely astonishing.

Lutnick is known for his multi-billion-dollar stake and long-time leadership at the investment bank Cantor Fitzgerald.

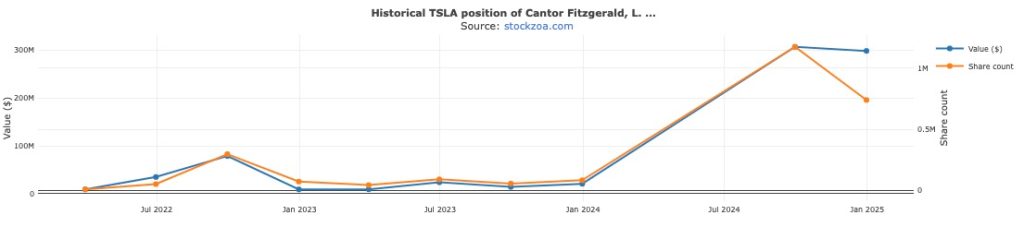

Starting in 2022, Cantor Fitzgerald began to buy Tesla stocks and significantly increased its investment in the automaker in 2024 during a bull run:

After Trump won the election last year with the help of a $250 million political donation from Elon Musk, the Tesla CEO started to recommend Lutnick for the significant role of Secretary of the Treasury. He tweeted:

My view fwiw is that Bessent is a business-as-usual choice, whereas Howard Lutnick will actually enact change. Business-as-usual is driving America bankrupt, so we need change one way or another,”

Trump ended up going for Bessent, but Lutnick still managed to land the role of Secretary of Commerce – with the help of Musk’s push.

After being nominated by Trump, Lutnick said that he would be divesting from his holdings, which are mainly linked to Cantor Fitzgerald, within 90 days.

The 90 days are not up yet, but there is no update on whether he has started divesting yet.

Today, he went on Fox News and recommended viewers buy Tesla stocks:

“I think if you want to learn something on this show tonight, buy Tesla. It’s unbelievable that this guy’s stock is this cheap. It’ll never be this cheap again,”

Here’s the video:

The blatant stock pump comes after Tesla’s stock lost more than 40% of its value so far this year.

Musk uses 238 million Tesla shares worth over $55 billion as collateral for personal loans. If Tesla’s stock goes too low, he could potentially be forced to sell his shares to cover the debt.

Furthermore, on the analyst side, Cantor Fitzgerald just upgraded Tesla’s stock to a buy earlier this week – raising their price target to $425 a share. Tesla’s stock closed at $235.86 today.

Howard Lutnick’s son, Brandon, is now in charge of Cantor Fitzgerald as Chairman.

Here’s a summary of Cantor Fitzgerald’s Tesla holdings:

- Early 2022: The firm held a very small position (only ~8,400 Tesla shares in Q1 2022) but rapidly increased to about 297,000 shares by Q3 2022 (worth ~$79 million at the time). This large buy-in during mid-2022 marked a significant ramp-up in their Tesla exposure.

- Late 2022: By the end of 2022, Cantor dramatically cut back its stake – holding roughly 72,000 shares in Q4 2022. This reduction from nearly 300k shares the prior quarter coincided with a steep drop in Tesla’s stock price in late 2022 (shares fell by roughly 50% during Q4 2022).

- 2023: Throughout 2023, Cantor Fitzgerald kept a modest Tesla position, fluctuating in the tens of thousands of shares. For example, they reported ~44,000 shares in Q1 2023, increased to 91,000 by Q2 2023, then adjusted to 56,000 in Q3 2023 and 83,000 by Q4 2023.

- These moves suggest active trading around Tesla’s short-term moves, with no huge long-only stake during 2023. Notably, it appears Cantor completely exited Tesla in early 2024 – Tesla was not listed in their Q1–Q2 2024 13F filings, implying they sold off the remaining shares during that period (when Tesla’s price rallied to local highs).

- Re-entry in 2024: In the second half of 2024, Cantor Fitzgerald made a bold re-entry into Tesla. Their holdings surged to about 1.2 million shares in Q3 2024 (valued ~$307 million as of September 30, 2024). This coincided with a mid-2024 pullback in Tesla’s stock price, suggesting Cantor bought the dip. By the end of 2024, they trimmed the position down to ~740,000 shares (from 1.2M), likely taking profits after Tesla’s price rallied late in the year.

Electrek’s Take

I mean, wow. This is something else.

Top comment by Togga

In Norway, that would be called corruption and inside trading. I guess Norway's pension fund would soon have to withdraw from the 1% stake in Tesla as it is beginning to look like an unethical stock.

The fact alone that a US secretary would recommend buying a specific stock is despicable, but it’s even more insane when it is the stock behind the fortune of Elon Musk, who has a relationship with Lutnick.

Lutnick’s Cantor invests in Tesla -> Musk invests in Trump -> Trump appoints Lutnick at Musk’s recommendation -> Tesla’s stock crash –> Trump recommends buying Tesla cars –> Lutnicks recommends buying Tesla stocks.

I’m no lawyer so I’m not going to claim whether this is legal or not, but it’s certainly not ethical.

Tesla must be really struggling if that’s what they are doing now: using US officials to promote Tesla’s stocks.

FTC: We use income earning auto affiliate links. More.

Comments