Rivian (RIVN) will report its third-quarter earnings on Thursday after market close. After a supply shortage hampered production, investors are wondering if the EV maker will see its first revenue drop since becoming a public company. Here’s what to watch for in Rivian’s Q3 2024 earnings report.

What to expect from Rivian’s Q3 2024 earnings

Update 11/07/24: Rivian releases third-quarter financial earnings (see the breakdown here).

Rivian delivered 10,018 vehicles in the third quarter, 27% fewer than the 13,790 handed over in Q2 2024.

After a supply shortage began in Q3, impacting the R1T, R1S, and electric delivery vans (EDVs), Rivian cut its production target for the year. Instead of the previous 57,000, Rivian now expects to build between 47,000 and 49,000 vehicles in 2024.

With another 13,157 built last quarter, Rivian’s production total reached 36,749 through the first nine months of 2024. This means another 12,251 to 10,251 EVs will need to be made at its Normal, IL plant in the final three months of the year.

Despite the lower production outlook, Rivian expects slightly more deliveries than last year. Rivian plans to deliver between 50,500 and 52,000 EVs in 2024, up from 50,122 in 2023.

| Q1 2024 | Q2 2024 | Q3 2024 | 2024 YTD | 2024 guidance | |

| Deliveries | 13,588 | 13,790 | 10,018 | 37,396 | 50,500 – 52,000 |

| Production | 13,980 | 9,612 | 13,157 | 36,749 | 47,000 – 49,000 |

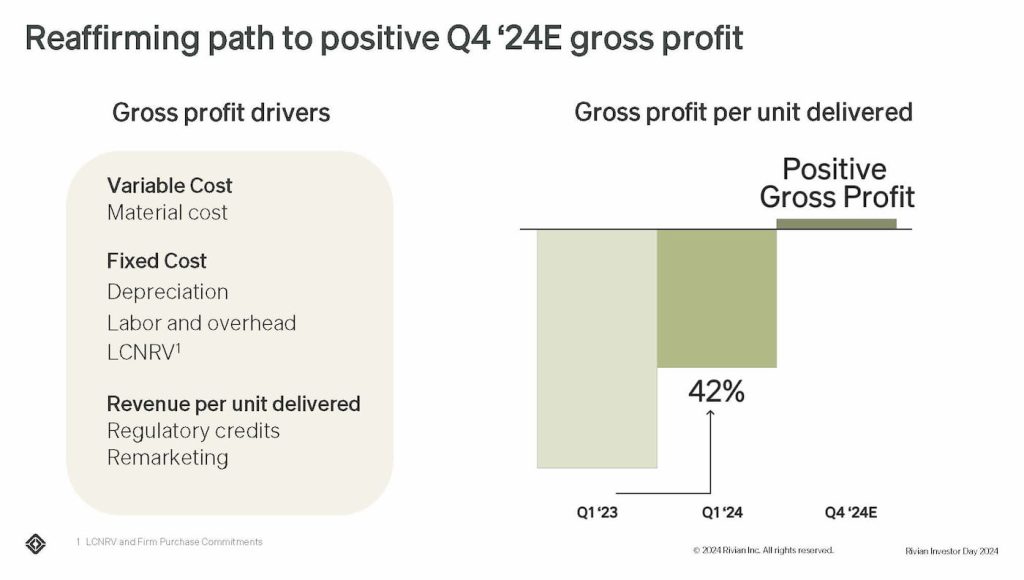

Although during its first Investor Day in July, Rivian said it still expects to achieve its first profit in Q4 2024, the supply shortage may have thrown plans off.

According to a recent Bloomberg report, the shortage was caused by a miscommunication with its supplier, Essex Furukawa, earlier this year. The mishap has left Rivian without enough copper windings to hit its initial production target.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

Rivian’s losses reached $1.46 billion in the second quarter, up from $1.2 billion in Q2 2023. The company lost $32,705 on every EV built last quarter. Will the losses improve despite lower output?

In preparation for its smaller, more affordable R2, Rivian has been aggressively cutting costs and introducing new tech, which is enabling much lower production costs.

Rivian’s CEO RJ Scaringe said upgrades at its Normal, IL plant earlier this year were a “pivotal” moment. In addition to its advanced new tech and improved supplier relations, the change will enable “significant cost reductions,” according to Scaringe.

Looking ahead

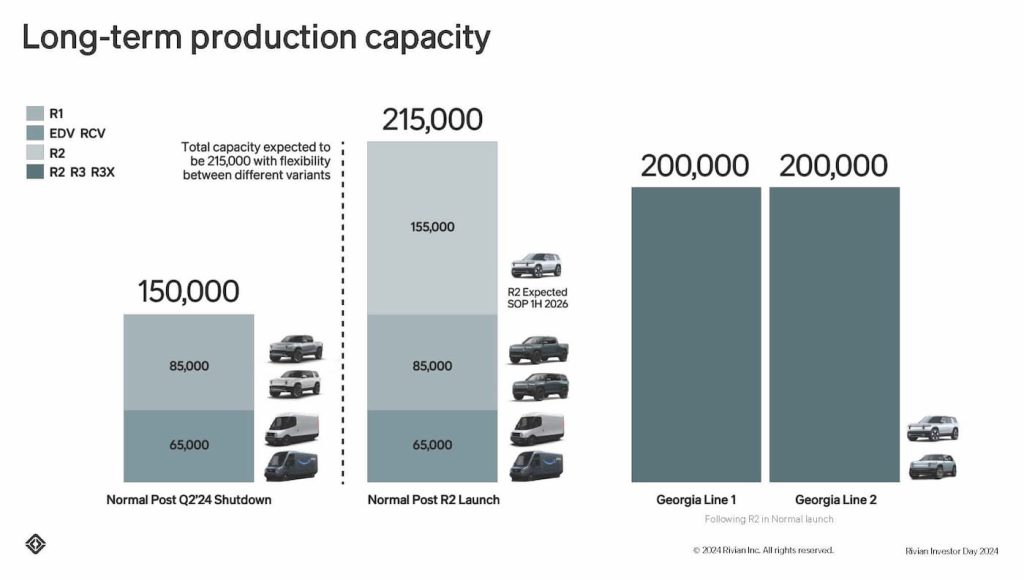

The new tech will serve as the foundation for Rivian’s next-gen R2. Rivian is expected to begin R2 production at its Normal facility in early 2026.

Starting at $45,00, the R2 is nearly half the cost of Rivian’s current R1S and R1T, which is expected to help drastically expand its market.

Once R2 production begins, Rivian expects the new EV will account for most of its output. The company plans to build 155,000 R2 models annually and about 85,000 R1S and R1Ts in Normal.

Rivian also received backing from Volkswagen through a new software alliance for next-gen EVs. Volkswagen will invest up to $5 billion, $3 billion of which will go to Rivian and $2 billion for the joint venture. However, these are based on performance targets.

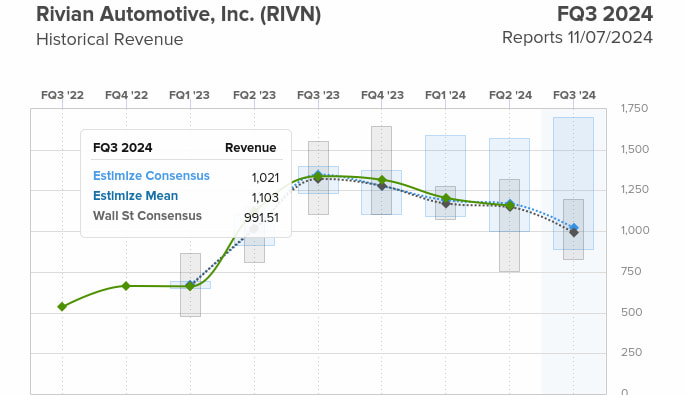

According to Estimize, Rivian is expected to report a loss of $0.96 per share in Q3 2024, an improvement from the 1.19 loss per share last year. Rivian is expected to report around $1 billion in revenue, which would be a 26% drop from the $1.34 billion in Q3 2023.

Rivian’s stock is down over 53% in 2024 and over 90% from its all-time high set shortly after going public in November 2021.

Check back tomorrow after the market closes for a breakdown of Rivian’s third-quarter earnings.

FTC: We use income earning auto affiliate links. More.

Comments