Tesla’s stock (TSLA) surged 12% today, one of its best days in a long time, as Elon Musk tries to position Tesla to ride the artificial intelligence wave.

In a rare occurrence, Tesla had a pretty bad miss on expectations for both revenue and earnings with its financial results in Q1 2024.

Despite the miss, Tesla’s stock surged 12% today. That’s quite the anomaly. So, what gave investors more confidence in Tesla?

There were a few important positive points in Tesla’s results.

First off, Tesla’s automotive gross margins virtually stayed the same despite further price costs, the Cybertruck ramp, and the Model 3 Highland ramp in Fremont. The company confirmed that if you remove those, margins did improve in Q1.

There’s also Tesla’s announcement that it changed its plans about how to bring cheaper vehicles to market. As we previously reported, Tesla postponed NV9, a new “$25,000 Tesla” based on the automaker’s new “unboxed” manufacturing technology.

Many investors and analysts were concerned about this, as a large percentage of Trsla’s expected growth over the second half of the decade was based on this model.

Now, Tesla has confirmed that its change in strategy still involves cheaper model, albeit likely not a $25,000 one, but they will be built on existing manufacturing lines. This was a big positive for investors – although the plan is currently light on details.

The third factor that is likely greatly contributing to Tesla’s stock having one of its best days in a while is the AI wave.

As we previously reported, Musk is virtually putting Tesla all-in on Robotaxi. The CEO again reiterated that if you don’t believe that Tesla can solve autonomy, you shouldn’t own the stock.

Musk is trying to position Tesla to ride the AI wave that is currently taking over the tech industry.

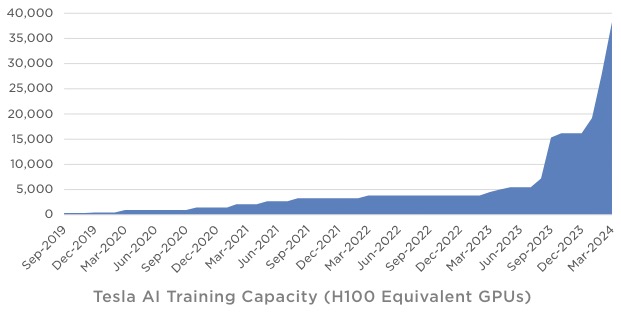

An interesting new thing that the company did with these earnings is that it released its AI training compute capacity:

This is truly impressive and still growing. As we previously reported, Tesla is currently building a massive 100 MW data center with NVIDIA hardware at Gigafactory Texas, which the company is hoping to bring online this August.

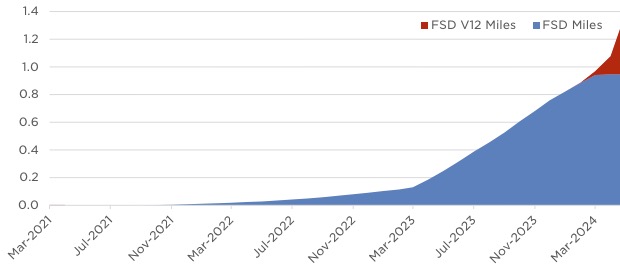

Tesla plans to use this AI training capacity to train its Full Self-Driving system with the millions of miles being driven with the “supervised” version of the system:

The data is also accelerating on that front with the release of v12 and the FSD one-month free trial.

While many people remain skeptical, it does appear that Tesla is gaining credibility regarding AI and its self-driving effort, which is contributing to the stock surge.

Electrek’s Take

If you have been following my pieces, you know that I haven’t been the biggest fan of FSD, but I’ve been impressed with v12 so far.

Things could get interesting fast.

Tesla now has the AI training capacity to compete with the biggest AI players and it is growing fast. The automaker is taking a similar approach as it did with battery cells: buying everything you can get your hands on from suppliers and building your own.

For batteries, that means buying from Panasonic, LG, CATL, etc, and building 4680 cells itself.

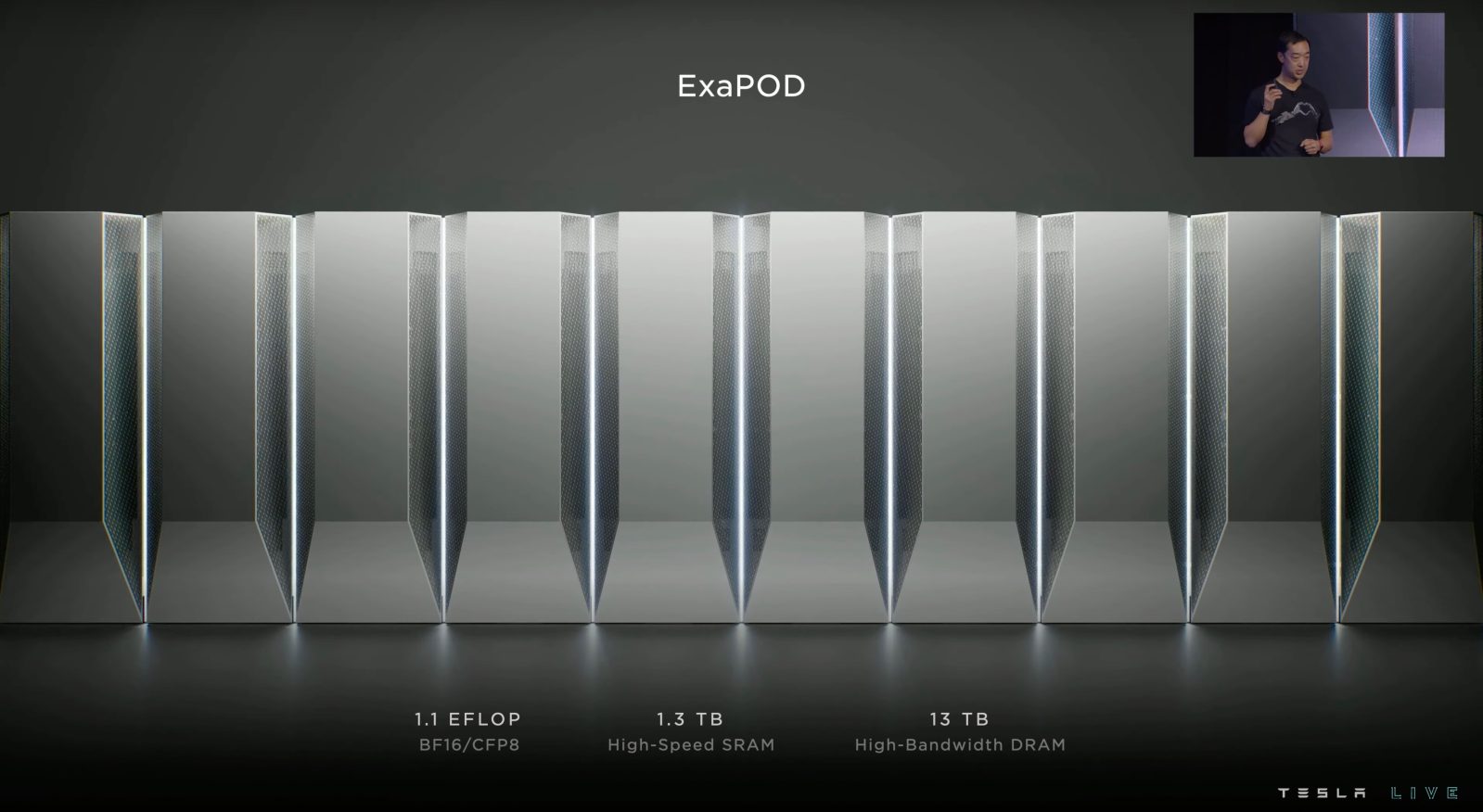

For AI training compute, it means buying servers from NVIDIA and building Dojo.

Top comment by Preston

I think investors are more reacting to the news that Tesla is going to use spare capacity to quickly bring new lower-cost models to market. Tesla is a new position for the company where they have more production capacity than demand, and now they've said what they are doing about that.

It worked for batteries and it could work for AI training also. I think Tesla deserves a meaningful credibility bump in the self-driving space with v12.

Honestly, if I see decent improvements over the next few updates, I might become a true believer. I had FSD Beta on my car for the better part of 2 years and saw very few improvements. v12 alone felt like a 20-30% overall improvement and I’m now way more confident when using FSD.

With that said, it’s important to remain extremely vigilant when using FSD. You need to be ready to take control at all times.

And at the risk of repeating myself for a thousand time, Tesla should release FSD disengagement data.

FTC: We use income earning auto affiliate links. More.

Comments