Here’s all you need to know about the US Department of the Treasury’s EV charger tax credit eligibility for individuals and businesses.

The 30C EV charging tax credit

When the Inflation Reduction Act became law in August 2022, it provided a tax credit for up to 30% of the cost of qualified EV charging “property.” Internal Revenue Service and US Department of the Treasury have clarified that the Alternative Fuel Vehicle Refueling Property Credit (section 30C) EV charging tax credit applies to each charging port and its “functionally interdependent components.”

“This one simple clarification should positively impact infrastructure deployment as industry players can now more comfortably move forward with projects leveraging this tax credit,” Suncheth Bhat, chief commercial officer at EV Realty, told Electrek.

The US Treasury’s EV charger tax credit (which is claimed using IRS Form 8911) is limited to $1,000 for individuals claiming for home EV chargers and $100,000 – up from $30,000 – for business properties. That came into effect on January 1, 2023.

The credit may also be claimed by tax-exempt and governmental entities using elective pay.

Location, location, location

In order to qualify for the 30C EV charging tax credit, individuals and businesses need to be located in an “eligible census tract.” The IRS defines an eligible census tract as:

… any population census tract that is a low-income community or that is not an urban area. Approximately two-thirds of Americans live in eligible census tracts.

Business and tax-exempt governmental entities claiming the Alternative Fuel Vehicle Refueling Property Credit can receive an enhanced credit if they are paying workers prevailing wages and using registered apprentices to install the equipment.

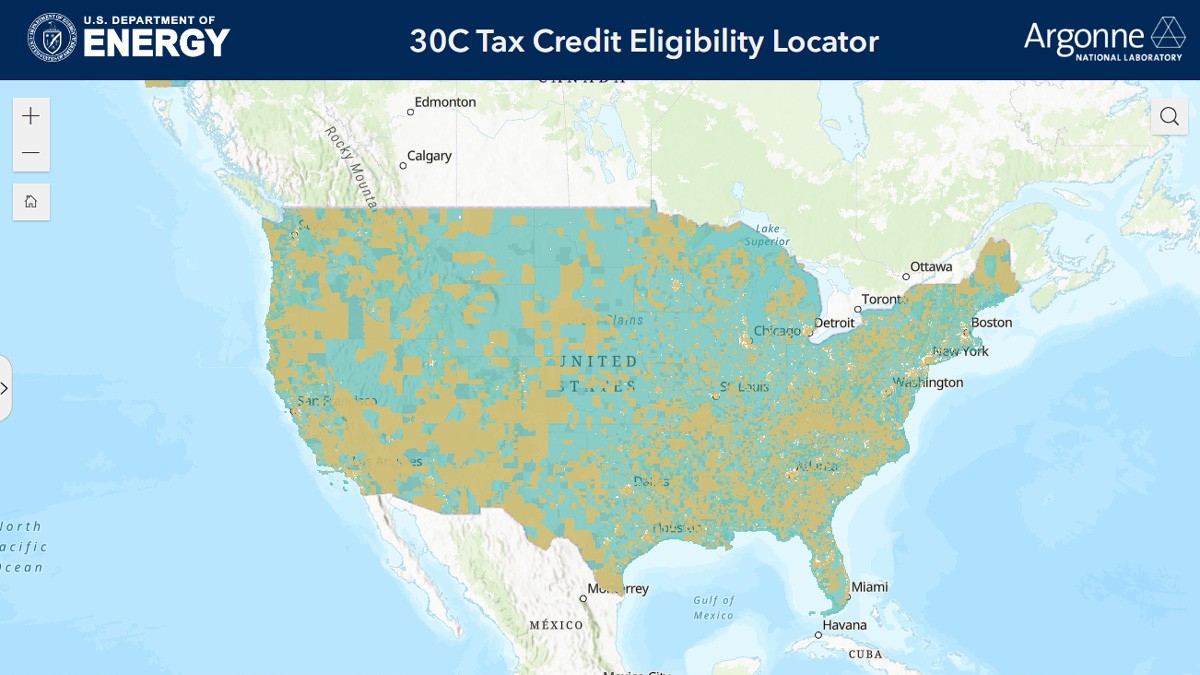

The US Department of Energy and Argonne National Laboratory released a mapping tool to help individuals and businesses find out whether they’re eligible for the 30C EV charging tax credit. (Note that there’s a disclaimer on the map that says it’s not formal IRS guidance – and neither is this article! – so when the time comes to file your taxes, consult with a tax professional to confirm eligibility.)

The Zero Emission Transportation Association’s (ZETA) executive director, Albert Gore III, said, “Developing our nation’s charging network is crucial to transportation electrification. As one of the principal incentives for charging infrastructure, 30C will help fill in charging gaps and attract investment to rural and lower-income communities. It will also help comfort potential EV drivers with the transition as they see more publicly available infrastructure.”

You can find the 30C Tax Credit Eligibility Locator map here.

Argonne also has a helpful FAQ about the 30C tax credit here.

Read more: Here’s how much money you’ll get with the Inflation Reduction Act

If you’re an electric vehicle owner, charge up your car at home with rooftop solar panels. To make sure you find a trusted, reliable solar installer near you that offers competitive pricing on solar, check out EnergySage, a free service that makes it easy for you to go solar. They have hundreds of pre-vetted solar installers competing for your business, ensuring you get high quality solutions and save 20-30% compared to going it alone. Plus, it’s free to use and you won’t get sales calls until you select an installer and share your phone number with them.

Your personalized solar quotes are easy to compare online and you’ll get access to unbiased Energy Advisers to help you every step of the way. Get started here. –ad*

FTC: We use income earning auto affiliate links. More.

Comments