The UAW has launched an unprecedented campaign to unionize the entire US auto sector at once, with thousands of auto workers at 13 companies announcing simultaneous unionization campaigns.

After UAW’s big strike win, winning 25%+ pay increases at the “Big Three” American automakers after a simultaneous strike at GM, Ford, and Stellantis, the union is looking to maintain that momentum and go bigger.

Immediately after declaring victory, UAW President Shawn Fain said that in the next negotiation in 2028, UAW wants to come back to the bargaining table to negotiate not just with the Big Three but with “a Big Five or a Big Six” – implying that the union planned to expand to other automakers. And President Biden said that he would support a UAW push to unionize Tesla and Toyota.

Now we’ve seen an official announcement that UAW isn’t just looking to unionize two or three more automakers, but all of them at once. Typically, unionization campaigns focus on a single company at a time, but here, UAW is targeting a whole sector with simultaneous campaigns at each company. This seems like a tall order, but UAW’s triple-strike against the Big Three seemed to work out well, so it’s now applying that simultaneous tactic to organizing new union drives.

In service of its goal, UAW launched a new website at uaw.org/join, asking workers at each company to sign their union card. The website mentions several automakers by name and has links to individual campaigns for each automaker where workers can go to express their interest in unionizing:

The campaign was accompanied by a video narrated by Fain making his union pitch. In short, UAW says that while automakers and investors are making record profits, worker compensation has not kept up. The video specifically mentions Tesla’s and Rivian’s recent quarterly results and also states that the Japanese/Korean automakers have combined to make $470 billion in profits. The German automakers have made an additional $460 billion in the last 10 years.

Since the UAW’s big wins, other automakers have moved to increase pay to (partially) keep up with pay increases at the Big Three. VW, Hyundai, Toyota, and Honda have all announced hikes in pay, showing how union wins can buoy an entire industry by making automakers compete for workers with higher pay.

But UAW doesn’t want to stop at a few voluntary pay hikes from other companies. It thinks that unionizing those companies can give workers a better deal. One worker at Toyota’s Georgetown, Kentucky, plant put it thusly:

We’ve lost so much since I started here, and the raise won’t make up for that. It won’t make up for the health benefits we’ve lost, it won’t make up for the wear and tear on our bodies. We still build a quality vehicle. People take pride in that, but morale is at an all-time low. They can give you a raise today and jack up your health benefits tomorrow. A union contract is the only way to win what’s fair.

Jeff Allen, 29-year Toyota assembly worker

UAW also quoted workers at Hyundai, VW, Mercedes, and Rivian in its release, focusing on how they think unionization would improve safety and benefits at these automakers.

The UAW says that “thousands” of auto workers are already involved in organizing efforts, with the goal of eventually unionizing approximately 150,000 auto production workers across non-union automakers, which would roughly double the number of unionized auto workers in the US.

Surely every company targeted by UAW won’t vote to unionize all of a sudden, but the union seems to be pushing for as much success as it can get. This would be a first in terms of unionizing foreign automakers in the US, as well – notably, while all German automakers are similarly unionized under one union, IG Metall (and German law requires board representation for labor for companies over a certain size), those German automakers are not unionized in the US.

Electrek’s Take

Unions are having a bit of a moment in the US, reaching their highest popularity ever since surveys started asking about them.

Much of union popularity has been driven by COVID-19-related disruptions across the economy, with workers becoming unsatisfied due to mistreatment (labeling everyone “essential,” companies ending work-from-home) and with the labor market getting tighter with over 1 million Americans dead from the virus and another 2-4 million (and counting) out of work due to long COVID.

Unions have seized on this dissatisfaction to build momentum in the labor movement, with successful strikes across many industries and organizers starting to organize workforces that had previously been non-union.

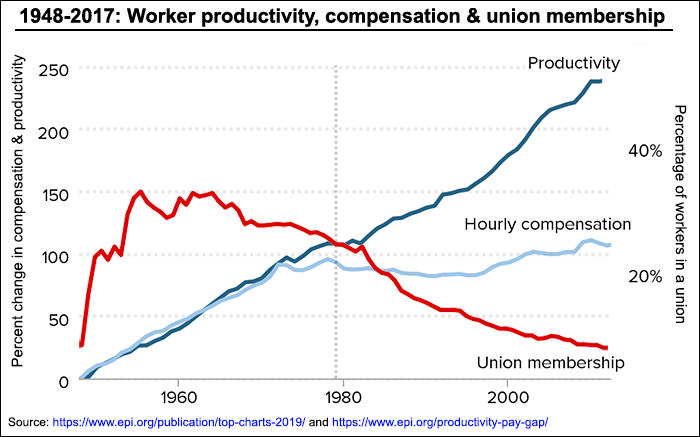

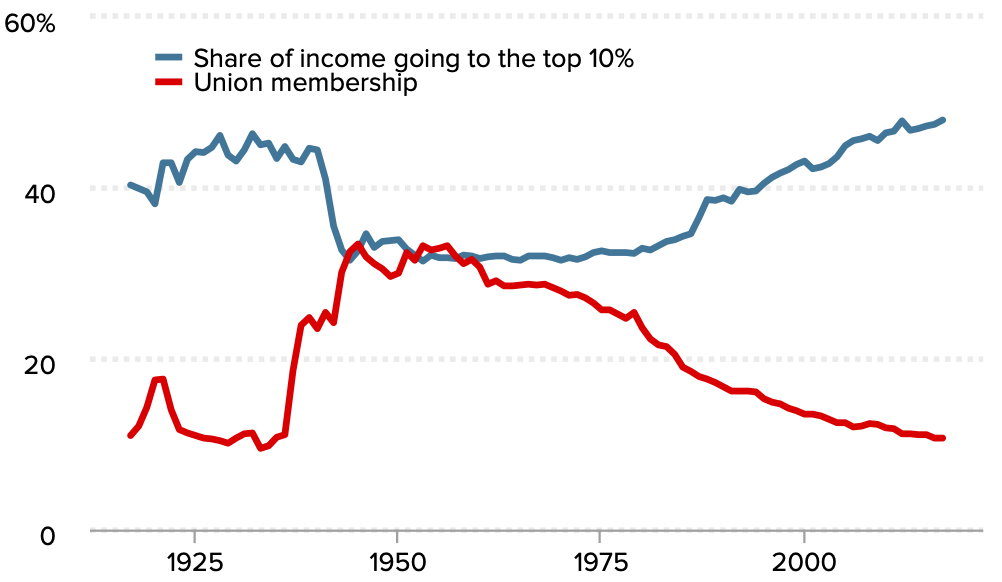

However, union membership has been down over several decades in the US. As a result, pay hasn’t kept pace with worker productivity, and income distribution has become more unequal over time. It’s really not hard to see this influence when you plot these trends against each other.

It’s quite clear that lower union membership has resulted in lower inflation-adjusted compensation for workers, even as productivity has skyrocketed. As workers have produced more and more value for their companies, those earnings have gone more and more to their bosses rather than to the workers who produce that value. It all began in the ’80s, around the time of Reagan – a timeline that should be familiar to those who study social ills in America.

Top comment by Ian Ollmann

For those wondering WTH happened in 1978, while it is easy to blame Reagan and trickle down economics, it is in fact the case that neither Reagan nor tax policy sets salaries. Companies (for the most part) set salaries, and what happened in 1978 to companies was a bunch of investor activism that ended stakeholder primacy in favor of shareholder primacy.

Where did all that money go? It went to shareholders, most of whom had nothing whatsoever to do with the success of the company and many of whom live on the other side of the world. While some did go to managers, true, there aren’t that many senior managers to enrich and the vast majority of it went out thw door to shareholders. Managers at least have something to do with the performance of the companies. Shareholders, nada.

For example when I was at Apple the stock buyback program was routinely 6 times larger than the entire salary base for all of R&D. Which of those two groups deserves the credit for the “insanely great”? Which of these two groups are a pile of parasites? Who got the lions share of the money? Shareholder primacy is what done you in. While unions will help, what would really help is employee representation in the boardroom.

All of this isn’t just true in the US but also internationally. If you look at other countries with high levels of labor organization, they tend to have more fair wealth distribution across the economy and more ability for workers to get their fair share.

We’re seeing this in Sweden right now, as Tesla workers are striking for better conditions. Since Sweden has 90% collective bargaining coverage, it tends to have a happy and well-paid workforce, and it seems clear that these two things are correlated. And while that strike is continuing, meaning we haven’t yet seen the end of it, most observers think that the workers will eventually get what they want since collective bargaining is so strong in that country.

These are all reasons why, as I’ve mentioned in many of these UAW-related articles, I’m pro-union. And I think everyone should be – it only makes sense that people should have their interests collectively represented and that people should be able to join together to support each other and exercise their power collectively instead of individually.

This is precisely what companies do with industry organizations, lobby organizations, chambers of commerce, and so on. And it’s what people do when sorting themselves into local, state, or national governments. So naturally, workers should do the same. It’s just fair.

FTC: We use income earning auto affiliate links. More.

Comments