EV maker Rivian’s stock is plummeting Thursday after revealing plans to issue $1.5 billion in convertible debt. In connection with the offering, Rivian also released preliminary third-quarter revenue.

After beating expectations earlier this week, delivering 15,564 electric vehicles in the third quarter, Rivian’s stock is sinking Thursday.

Rivian said in a new 8K filing that it plans to offer $1.5 billion in green convertible senior notes. The convertible debt is due in 2030.

The fundraising comes one day after CEO RJ Scaringe told CNBC’s “Squawk Box“ that Rivian was focused on deploying capital efficiently and is “very comfortable with the fact that we’ve maintained a strong balance sheet.”

Scaringe avoided the question as to whether Rivian would need to raise funds before introducing its next-gen R2 products.

“What we’re going to see is a very clear staircase or set of steps that get us to profitability as a business,” Scaringe explained in the interview.

Rivian’s stock plummeting on cash raise plans

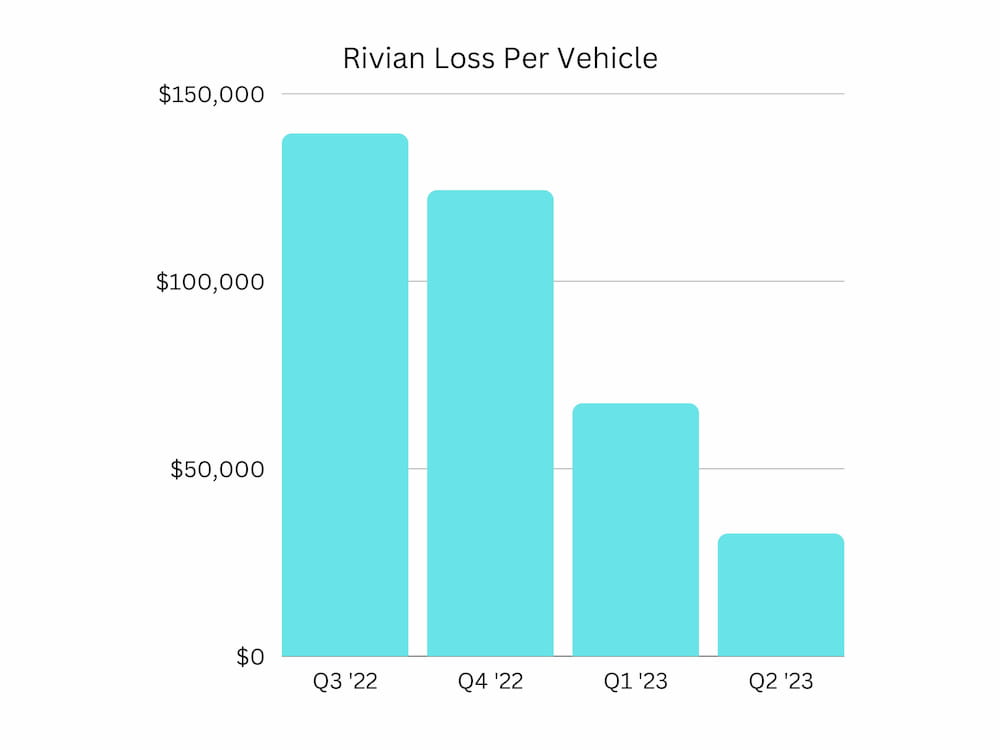

Rivian’s loss per vehicle has been improving each quarter as it ramps production. In the second quarter, Rivian lost $32,594 on every vehicle it delivered. Although it is still a large deficit, it’s a 50% improvement from Q1’s loss per vehicle of $67,329.

Rivian has delivered 36,150 electric models through the first nine months of the year and is on track to build 52,000 units this year.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 |

The EV maker ended the second quarter with around $9.2 billion in cash. Scaringe explained in the interview this week that with ambitious growth plans, Rivian “does not want to be capital-constrained.”

Rivian also released preliminary third-quarter results indicating between $1.29 billion and $1.33 billion in revenue. The results align with the Wall St consensus of around $1.3 billion.

The convertible debt could dilute shareholders, which is likely why Rivian’s stock plummeted over 18% Thursday.

Rivian’s stock is now down over 45% in the past 12 months and over 88% from its all-time high shortly after going public two years ago. The EV maker will release final third quarter financials on November 7.

Electrek’s Take

A nearly 20% drop on a $1.5 billion convertible debt offering seems like an overreaction. Investors fear potential dilution as Rivian accelerates growth.

However, unlike many other startups, Rivian has a clear product roadmap and growth strategy. It will likely be able to repay the debt in another seven years, which may not be the case with other EV startups offering convertible notes.

Rivian has ambitious plans to expand as it ramps up production of three different electric vehicles: the R1T, R1S, and electric delivery van (EDV). In the meantime, it’s preparing for a new generation of EVs.

After introducing its in-house Enduro drive units and LFP battery packs, Rivian’s input costs are decreasing. The EV maker has been leveraging fixed costs while working to improve efficiency.

Check back for more info next month, as Rivian’s Q3 earnings will give us a better picture of the EV maker’s financial situation.

FTC: We use income earning auto affiliate links. More.

Comments