Vietnamese EV maker VinFast (VFS) reported rising Q3 revenue, EV deliveries, and vehicle sales on Thursday. However, most of the growth is due to sales to a related company.

VinFast’s EV deliveries reached 10,027 in Q3, up 5.2% from the second quarter’s 9,535. The company said it’s starting to see sales increase in North America, particularly Canada.

Despite this, VinFast founder Pham Nhat Vuong told investors on an analyst call that around 60% of sales (over 6,000) were to Green and Smart Mobility (GSM).

GSM is a rental and taxi company established by Vingroup, VinFast’s parent company, in March to expand the use of its electric cars and scooters throughout Vietnam.

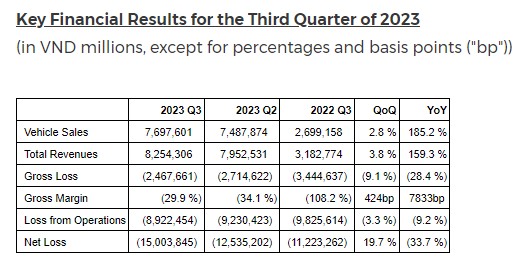

The affiliate company has accounted for around two-thirds of VinFast’s sales over the past two quarters. VinFast announced Q3 vehicle sales were $319.5 million, up 2.8% from Q2.

VinFast’s revenue rose 3.8% quarter-over-quarter to $342.7 million, primarily from vehicle sales (the company also sells electric scooters).

VinFast EV deliveries up in Q3, but losses also rise

The EV maker’s gross losses did decrease by 9.1% from Q2 to $102.4 million. However, net losses continued rising. VinFast’s losses reached $622.9 million, up almost 20% from last quarter.

VinFast ended the third quarter with $131 million in cash and equivalents. The company said Thursday it believes “it has sufficient runway to grow in the coming years and will continue to look for opportunities to strengthen its balance sheet.”

Meanwhile, Vuong has vowed to inject $2.5 billion into the company through loans and grants to boost growth. VinFast expects to receive up to $1.2 billion in grants over the next six months.

The Vietnamese EV maker reaffirmed its target of delivering between 40,000 and 50,000 vehicles this year.

With only 21,342 EVs delivered so far, VinFast will need to more than double output over the next quarter to hit its goal.

Vuong said on the earnings call he is “confident” vehicle sales will increase over the next quarter, citing new models like the new VF 6 and seasonality in Vietnam.

VinFast became a sensation after its explosive IPO in the US. Share prices soared to an intraday high of $93 on August 28, with a market cap of over $200 billion. In comparison, VinFast was worth more than Ford ($47 billion), GM ($41 billion), Volkswagen ($57 billion), Stellantis ($18 billion), and Rivian ($17 billion) combined.

Share prices are down over 90% from their ATH, settling around $8.50 per share. VinFast’s market cap is still nearly $20 billion, making it more valuable than Rivian, Lucid, Nissan, and Volvo.

FTC: We use income earning auto affiliate links. More.

Comments