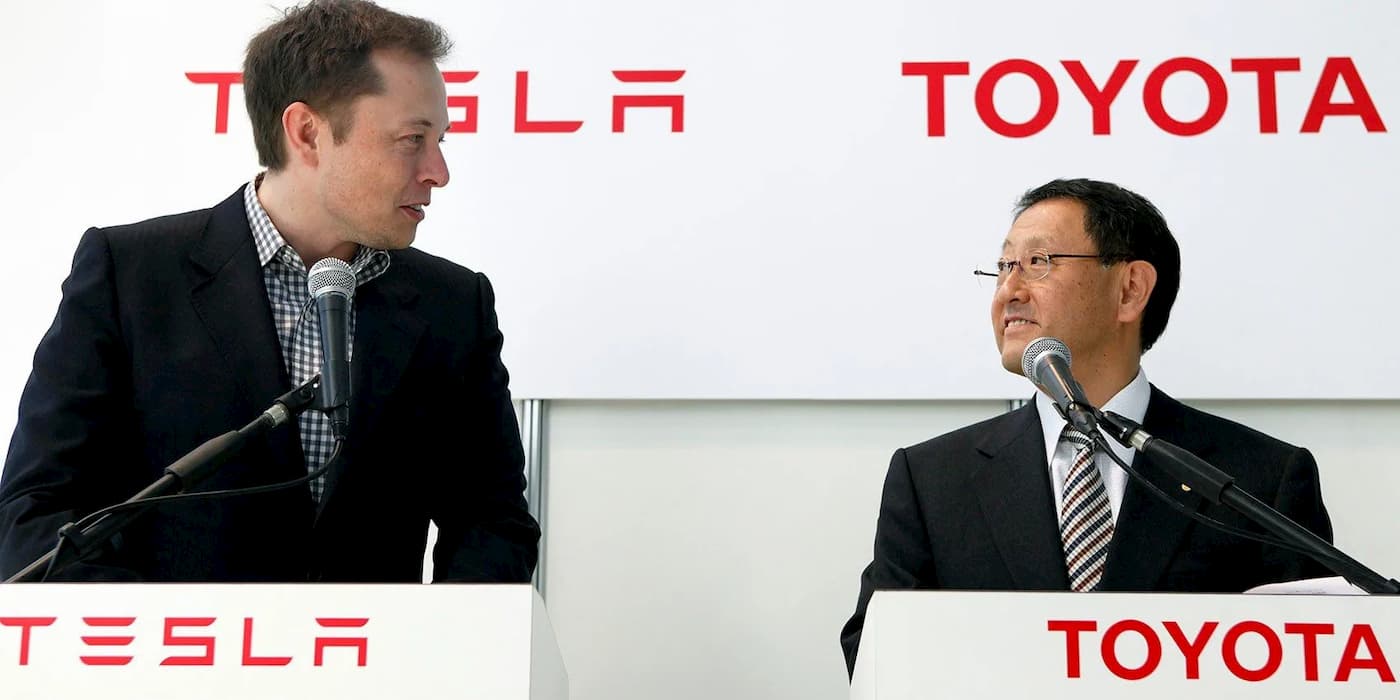

At a recent general meeting, Toyota’s shareholders raised concerns over Tesla and the lead it has established as the industry moves to electric vehicles.

Toyota shareholders concerned over Tesla’s EV lead

On two oppositive sides of the EV spectrum, you have Tesla, which sells 100% electric vehicles, and Toyota, which has been one of the biggest laggards (if not the biggest) regarding pure EVs.

Tesla delivered a record 466,140 electric models in the second quarter of 2023, crushing expectations again. The EV pioneer has delivered 888,000 units through the first half of the year and needs less than one million deliveries to hit its 1.8 million 2023 goal by the end of the year.

Meanwhile, of the over 4.15 million vehicles Toyota sold globally in 1H 2023, only a fraction (roughly 0.19%) were purely electric.

After shareholders raised concerns over Tesla and its dominant lead with EVs, several leaders were quick to point to Toyota’s hybrid approach, including hybrid and fuel cell vehicles (FCEV), a strategy that has already set them behind industry competitors.

Despite its resistance to going all-electric, the Japanese automaker has introduced several new ideas to accelerate its BEV strategy recently, several of them directly from Tesla’s playbook.

In May, Toyota’s newly elected CEO, Koji Sato, revealed the automaker was developing a “completely new platform designed exculsivly for BEVs” expected to launch in 2026.

And then last month, Toyota shared a few new technologies and processes it was working on to transform the company in the electric era including incorporating a simple body structure through Giga casting, a process used by Tesla to reduce the number of pieces needed to make the car.

Toyota plans to integrate advanced areodynamics with next-gen EV batteries that the company claims will drastically improve driving range compared to its first electric model, the bZ4X electric SUV, while slashing production costs by 2027.

President of Toyota’s BEV factory, Takero Kato, explained to shareholders “I love BEVs. Through BEVs, I want to change the future of cars, monozukuri, and work.”

First, he says, Toyota aims to produce EVs with the same cruising range as its hybrid vehicles. Then, the automaker will improve the vehicle structure and production process to optimize efficiency.

Longtime Toyota leader who stepped down from his position as CEO (remaining on the board) earlier this year, said:

I don’t know if love can beat Tesla. However, cars made by engineers who love them will move people’s hearts.

Toyota aims to sell 1.5 million EVs by 2026 with 10 new electric models including luxury, small cars, and commercial. The automaker plans to produce its first US-assembled EV, a three-row electric SUV, at its plant in Georgetown, Kentucky.

Electrek’s Take

I think Toyota’s shareholders know the answer and that’s why they are raising concerns over Tesla.

Top comment by Robert Aitchison

It's just crazy how Toyota squandered what could only be described as a commanding lead in electrification and allowed themselves to be overtaken by not just Tesla, but most large legacy automakers as well.

Continuing to rely on proven and practical Hybrid cars could easily be forgiven, or at least understood, but their stubborn focus on the boondoggle that is consumer FCEVs has harmed them tremendously.

Certainly don't want to count them out but they are going to have to work very hard to stay among the leading carmakers moving into the future.

Tesla is on track to hit 1.8 million deliveries by the end of the year while Toyota is aiming for 1.6 million in another three years. By that time, Tesla will have widened its lead by far.

Toyota continues wasting precious time and resources on inferior technology like fuel cell and hybrids, which will only slow the automakers transition even more.

The Japanese automaker seems to be recognizing the urgency after falling behind early. Its “multi-pathway” strategy is distracting it from what’s really important – developing and producing EVs.

While Tesla is laser focused on ramping production and optimizing efficiency along the way, Toyota seems to be taking several pages from the EV makers playbook while it continues investing in other technology. Not only will the strategy be costly in the end, but Toyota is far less likely to remain competitive with Tesla with its finger in every pie.

FTC: We use income earning auto affiliate links. More.

Comments