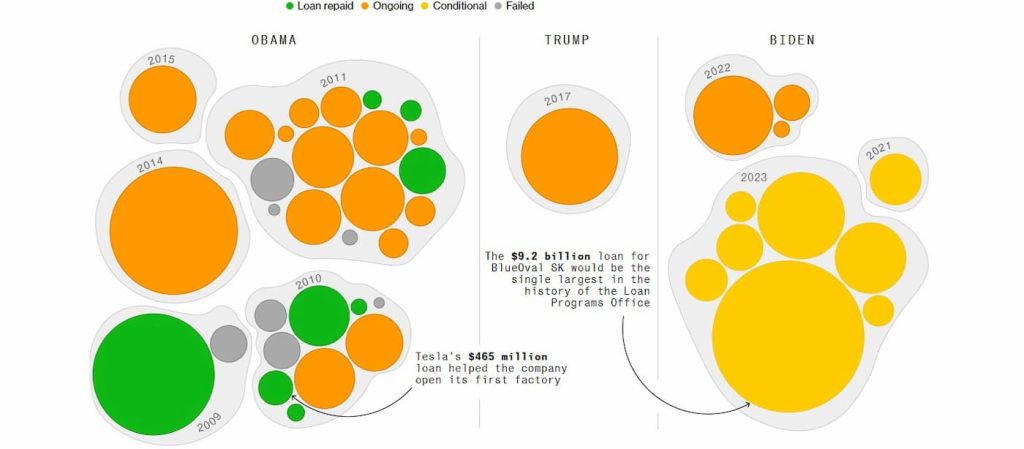

Ford Motor is set to receive the single largest loan in the history of the Department of Energy’s (DOE) Loan Program Office. The whopping $9.2 billion will be used to build three EV battery factories as Ford looks to boost domestic capacity.

The loan is also the largest (by far) since the US auto bailout sparked by the global financial crisis in 2009, according to Bloomberg.

Ford will use the funds to build three new battery factories. The automaker revealed plans to develop its “largest, most advanced and efficient auto complex” in 2021, called BlueOval City.

The new project consists of three battery factories in collaboration with SK Innovation. One will be at its nearly 6-square-mile site in West Tennessee alongside an assembly plant, while the other two are being built at its new BlueOvalSK Battery Park in Central Kentucky.

Altogether, Ford expects the three factories to generate 129 GWh of battery cells annually to support the automaker’s planned EV production ramp.

Ford expects to build around two million EVs per year by 2026 compared to about 132,000 it made in 2022. Once the factories are complete, Ford’s EV models, including a new electric truck codenamed “Project T3,” will be eligible for billions in incentives from the Inflation Reduction Act (IRA).

Currently, the Ford F-150 Lightning is the only EV model that qualifies for the full $7,500 tax credit. The Mustang Mach-E and E-Transit are eligible for $3,750.

Ford gets a $9.2 billion loan for EV battery production

Ford’s $9.2 billion loan is designed to expand EV battery production in the US, building out a domestic supply chain while reducing the nation’s reliance on China.

BlueOval CEO Robert Rhee said in a statement Ford “will use this loan to its fullest as we create 7,500 good American jobs.” The IRA is enabling US automakers to compete globally as the industry moves to a fully electric future while putting the US on a path to slash GHG emissions in half by 2030.

Top comment by Gussy23

Ford is more than capable of procuring conventional financing. It does not need government financing. It has a strong, liquid balance sheet and added $5 billion in cash at FYE'22. These sorts of loans should go to companies like Rivian and Aptera. Those are the kinds of companies that need the usually generous terms attached to government financing including deferment options which are almost always available. These loans are funded with our tax dollars. I would much rather my money be used to help smaller companies. Ford already gets my money through equity financing.

The Loan Programs Office (LPO), created in 2005 to advance clean energy projects, dished out nearly $33 billion over the past 14 years. Notably, in 2010, a $465 million loan helped Tesla ramp production at its first factory in Fremont, California.

Since the IRA was passed last August, lending through the LPO is around $400 billion. General Motors (GM) received $2.5 billion in funding last year, less than a third of Ford’s new loan.

The funding comes at a critical moment in Ford’s EV ramp-up. After splitting into three businesses to focus on their individual strengths to accelerate the company as a whole, Ford expects its EV unit (Model e) to lose $3 billion this year as it scales production.

By the end of 2026, the American automaker expects to turn things around with an 8% EBIT margin for the Model e division. Ford CEO Jim Farley told Bloomberg in an interview in March, “The biggest thing of scaling is batteries.”

FTC: We use income earning auto affiliate links. More.

Comments