Tesla (TSLA) investors see the negative impact of Elon Musk’s Twitter acquisition lasting on the company going forward.

There’s no doubt that Elon Musk’s acquisition of Twitter had a direct negative impact on Tesla and its investors, considering that the CEO had to sell billions of dollars worth of Tesla (TSLA) stock to finance the $44 billion acquisition.

The sale of that TSLA stock likely contributed to a sharp decline in Tesla’s stock price.

There’s also a less tangible impact on Tesla and that’s the perception of Elon Musk changing through his antics on Twitter. Many people have reported losing faith in Musk’s leadership after he made statements like sharing fringe conspiracy theories and asking his followers to vote republican on Election Day.

Sharing conspiracy theories and urging people to vote for a specific party are things that you generally don’t see from the CEO of major companies.

Now Morgan Stanley has surveyed its own clients who are Tesla investors to understand how they see the situation.

Analyst Adam Jonas wrote in a note to clients today:

Our investor survey reinforces our views that Elon Musk’s recent involvement with Twitter has contributed to negative sentiment momentum in Tesla shares and could drive some degree of adverse downside skew to Tesla fundamentals.

Top comment by Bob Anderson

It would be a disaster in the short term if elon wasn't ceo, but I listen to every earnings call and to this day, the most competent one was the one he wasn't involved. He has assembled a good team, and I think it's time to let elon pursue his side projects. They're not the company of 2018 struggling to ramp, and they are on a good trajectory with or without musk. I think most Tesla investors believe Tesla will survive with or without him, but I personally would love less drama.

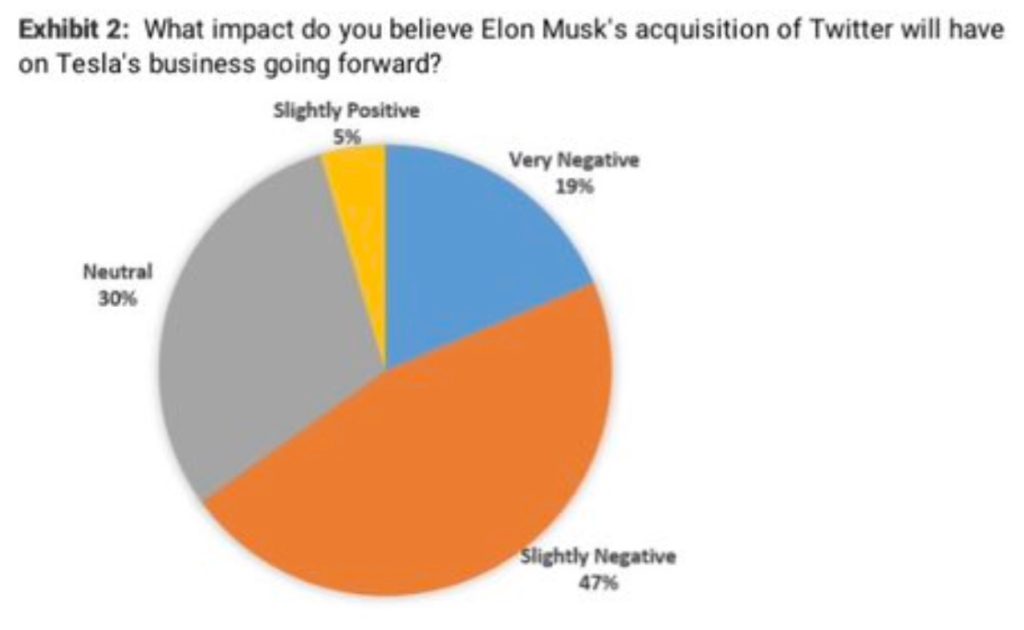

Interestingly, a strong majority of Tesla investors in the survey believed that the impact will keep being negative going forward:

However, Morgan Stanley maintains a positive outlook on Tesla’s stock as they believe there are significant upsides based on the current valuation:

Tesla is the only self-funding pure play EV name we cover and has achieved a unique position to secure supply of the battery metals and related up-stream supply necessary to produce EVs at multi-million-unit scale. In a slowing economic environment, we believe Tesla’s ‘gap to competition’ can potentially widen, particularly as EV prices pivot from inflationary to deflationary. The current price offers approximately 80% potential upside to our $330 price target which is the highest upside to target we have seen from Tesla in over 5 years.

Tesla’s (TSLA) stock is slightly up 0.3% this morning – trading at around $183 a share.

What about you? Do you feel like Musk’s Twitter antics are going to continue having a negative impact on Tesla going forward? Let us know in the comment section below.

FTC: We use income earning auto affiliate links. More.

Comments