Tesla (TSLA) is set to announce its first-quarter 2022 financial results tomorrow, April 20, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

Here we’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q1 2022 deliveries

As usual, Tesla already disclosed its Q1 vehicle delivery and production numbers, which drives the vast majority of the company’s revenue.

Earlier this month, Tesla confirmed that it delivered just over 310,000 electric vehicles during the first three months of the year.

That’s yet another all-time quarterly record for Tesla, the seventh in a row, and a massive result for a first quarter, which is generally weaker.

Delivery and production numbers are always slightly adjusted during earning results

Tesla Q1 2022 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers.

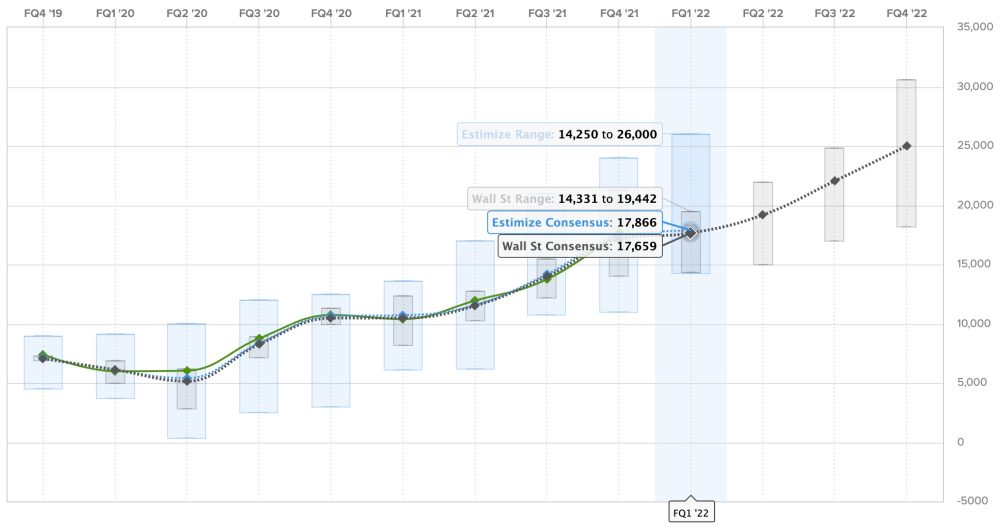

The Wall Street consensus for this quarter is $17.659 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $17.866 billion.

An average between the two numbers would be roughly what Tesla generated last quarter (Q4 2021), but it would represent tremendous growth versus the same period last year (Q1 2021) when Tesla delivered roughly $10 billion in revenue.

Here are the predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

Tesla Q1 2022 earnings

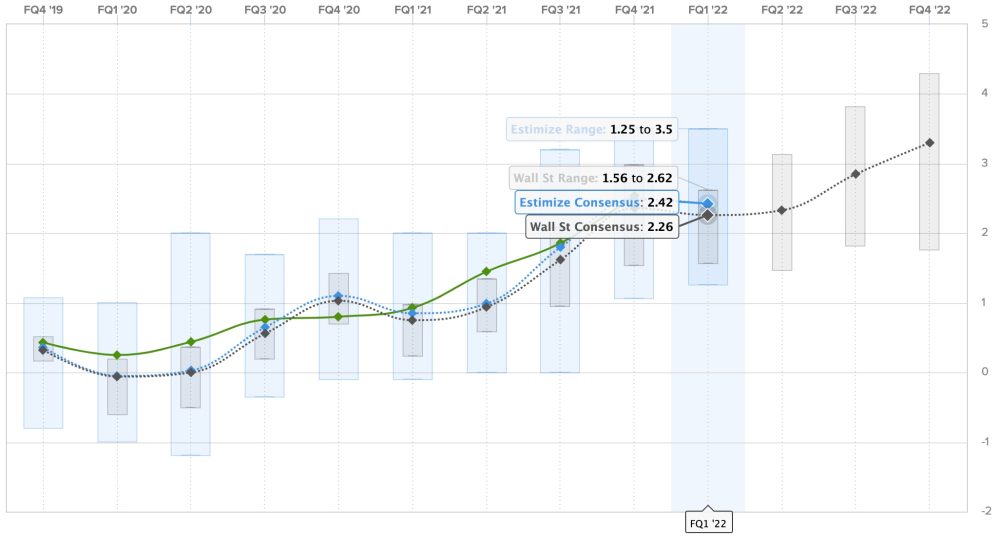

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful doing so over the last two years now.

For Q1 2022, the Wall Street consensus is a gain of $2.26 per share, while Estimize’s prediction is higher with a profit of $2.542 per share.

The earnings are more of a hit-or-miss since it depends on how much Tesla is spending that quarter, and with supply chain issues and costs increasing at new factories being brought online, it could be not as profitable despite the real potential for another record when it comes to revenues.

Or not. It’s hard to tell, but Tesla has been consistently beating earnings-per-share expectations over the last few quarters.

Here are the earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

In the shareholder’s letter and the following conference call, Tesla generally shares additional details about not only financial results, but also other important metrics on how the company is doing.

Tesla doesn’t share traditional guidance for the year in its first-quarter call as the company instead insists on only saying that it will grow at a rate of roughly 50% per year for the foreseeable future.

Last year, CEO Elon Musk announced that he wouldn’t participate in all quarterly calls like he used to, and like most CEOs of major public companies do. It’s not clear if he will be present at this one.

But Tesla is still expected to answer some shareholder and analyst questions.

Over the last few earnings calls, Tesla has been using the website Say to gather questions from retail investors and respond to the top-voted ones.

Some are direct and specific and some are more general in an attempt to get Tesla to talk about some subjects. Here are the top-voted ones right now:

- Is there a proposed stock split ratio?

- How does Tesla plan to secure raw materials required to scale to extreme size?

- What is the current run rate of 4680 cell production at Fremont and at Giga Texas? What do you expect run rates for 4680 to be in Fremont, Texas, and Berlin at year end?

- What is Tesla Construction team busy with these days? Are they planning expansion of existing factories or are they onto the next set of new giga factories? If factories are the product, we would like to see a next factory announcement before the next model.

- At Cyber Rodeo, Musk mentioned that a futuristic driverless Robotaxi vehicle is on the roadmap. When can we expect more details on this product offering to be unveiled? Is this something that people can own or will this only be offered by Tesla as a service?

What else are you looking for during Tesla’s earnings? Let us know in the comments section below, and join us tomorrow for our extensive coverage of the earnings.

FTC: We use income earning auto affiliate links. More.

Comments