Tesla (TSLA) gave an update on its Bitcoin holding in a new SEC filing – confirming that it now holds $1.99 billion in the cryptocurrency.

Early in 2021, Tesla invested $1.5 billion in Bitcoin.

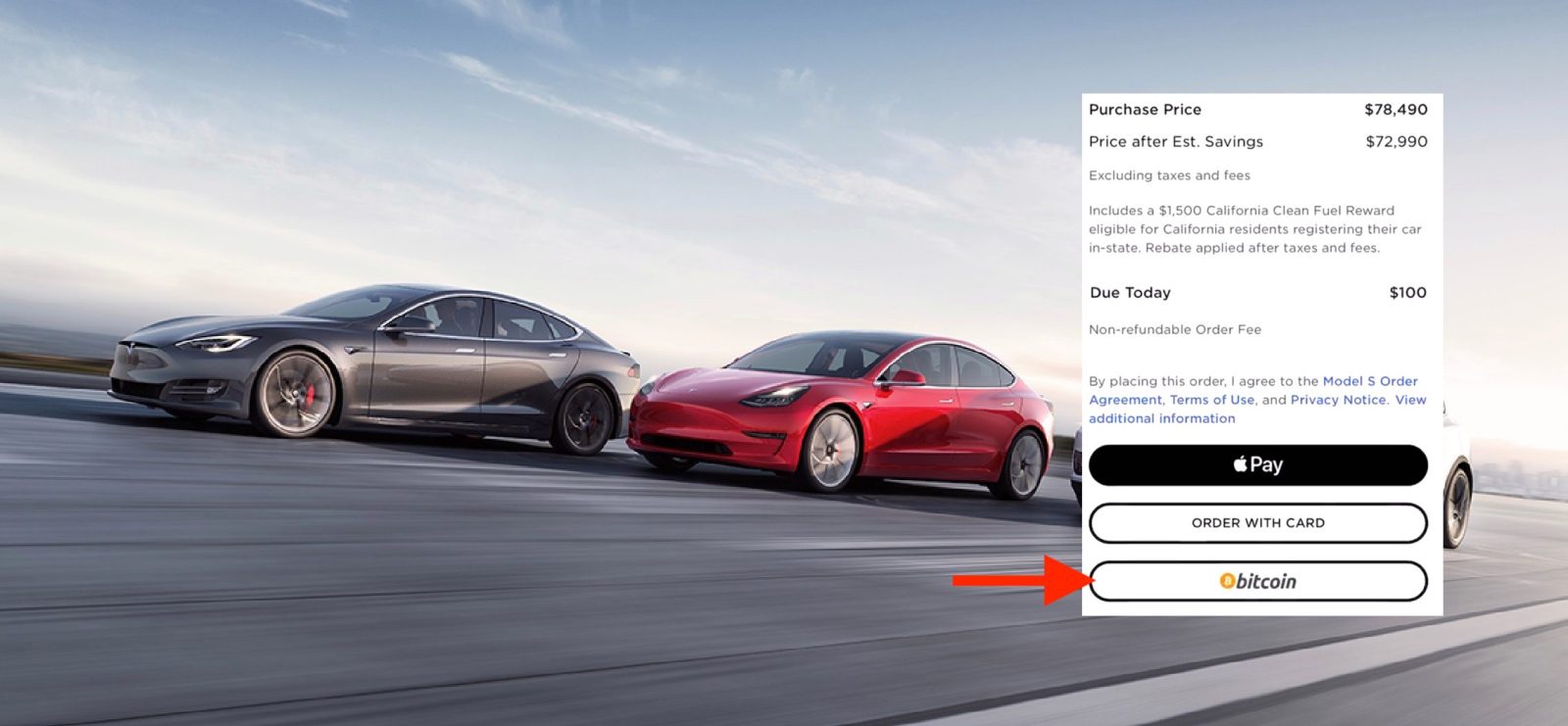

Shortly after, the automaker started accepting the cryptocurrency as payment on new vehicles.

However, a few days later, Tesla took a step back with crypto by removing the Bitcoin payment option. The company noted concerns over the energy needs of the Bitcoin network:

Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.

This is a concern that many Tesla community members shared when Tesla first announced its Bitcoin investment, and many were angered by the fact that the company didn’t think about it in the first place.

At the time, Tesla noted that they were not selling their stake in Bitcoin and that they planned to resume taking Bitcoin payments once the network shows a higher mix of renewable energy.

Last summer, CEO Elon Musk said that he believes Tesla will resume taking Bitcoin payment as he sees improvements in the energy mix of Bitcoin mining.

That has yet to happen, but Tesla is holding the crypto currency and gave an update in its latest 10K SEC filing released today.

The automaker confirmed that at current value and after selling part of its stake as a test of liquidity, it now holds about $2 billion in Bitcoin:

“During the year ended December 31, 2021, we purchased and received $1.50 billion of bitcoin. During the year ended December 31, 2021, we recorded $101 million of impairment losses on such digital assets. We also realized gains of $128 million in connection with selling a portion of our holdings in March 2021. Such gains are presented net of impairment losses in Restructuring and other in the consolidated statement of operations. As of December 31, 2021, the carrying value of our digital assets held was $1.26 billion, which reflects cumulative impairments of $101 million. The fair market value of such digital assets held as of December 31, 2021 was $1.99 billion.”

Last year, Tesla was briefly up by over $1 billion in Bitcoin during a surge in price.

Bitcion, along with the broader crypto market, have since crashed, but prices are going up again over the last few weeks – with Bitcoin being up 15% in the last week alone.

If you are interested in getting into crypto, my two favorite ways are Coinbase and crypto.com. With the latter, you can even spend your crypto through a regular Visa debit card. You can use my referral code (44sqxfg7zh) at crypto.com, and we each get $50 worth of crypto.

FTC: We use income earning auto affiliate links. More.

Comments