Tesla’s Chief Financial Officer, Taneja Vaibhav, and the head of Tesla’s board of directors, Robyn Denholm, have just sold tens of millions of dollars worth of Tesla (TSLA) stock.

Elon Musk’s brother is also selling.

Public companies must report insider stock trading by critical executives and board members to the SEC.

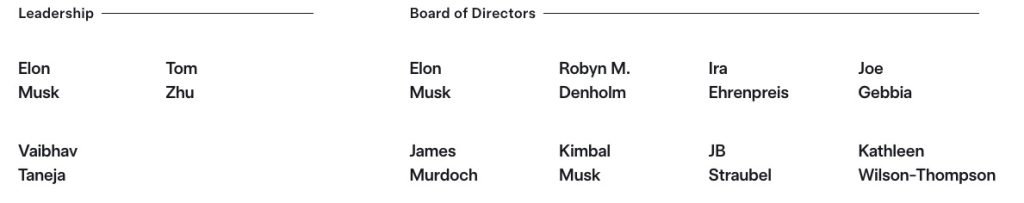

For Tesla, it’s a very limited group for a company of that size:

And they are not buying the stock. In fact, they are almost exclusively selling.

Today, Tesla reported two new sets of transactions in SEC filings.

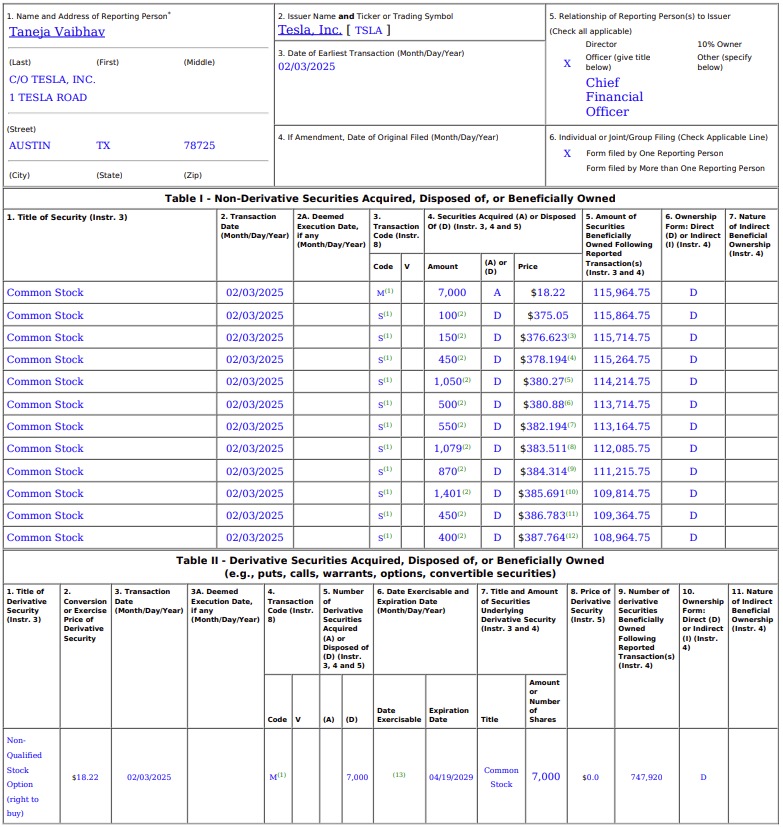

Chief Financial Officer Taneja Vaibhav confirmed that he sold 7,000 shares for $2,681,770.

He was able to acquire those 7,000 Tesla shares at $18.22 as part of his stock option plan. He sold at an average of $383, and the stock closed at $374 today.

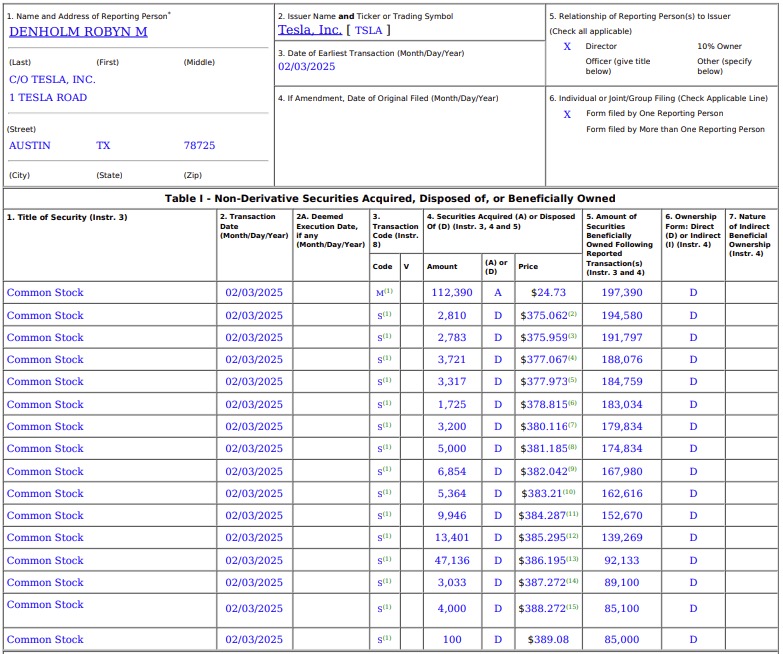

Robyn Denholm, Tesla’s chairwoman, sold 112,390 shares at an average price of $384.04, for a total value of $43,162,255.60.

She also got the shares as part of a stock option plan. Denholm had to return tens of millions of dollars worth of Tesla stocks to the company after settling a lawsuit over excessive compensation brought by shareholders.

Tesla’s entire board settled for nearly $1 billion:

Tesla wrote in the filings that both Vaibhav and Denholm sold as part of stock option liquidation plans adopted last year.

Today, Tesla released another SEC filing to disclose that Kimbal Musk, Elon Musk’s brother and Tesla board member who also was part of the excessive compensation settlement, is selling 75,000 Tesla shares through Morgan Stanley for $27.5 million.

In his case, it doesn’t appear to be linked to a liquidation plan.

Electrek’s Take

Top comment by AE

I don’t see any scenario ever Tesla sales grow anywhere outside of China.

USA and EU are definitely on the decline for the foreseeable future. You can get a used 3 for less than 20k and there’s plenty on the market. Even if they introduced a cheaper 3/Y I don’t see that changing the trajectory this is on.

The damage has been done and the cracks in the foundation are starting to be seen. Q1 is going to be bad, Q2 is going to be VERY BAD.

Kimbal is known to have great “timing” with his Tesla stock sales. It will be interesting to see.

It’s wild to see these board members getting absurdly rich while the company has erased its growth and is heading into one of its worst quarters in years.

All while they sit on their hands and do nothing while they are the only ones who could do something about the CEO, who seemingly engages in fireable offenses every day.

Tesla has one of the worst corporate governance of any major companies I’ve ever witnessed.

FTC: We use income earning auto affiliate links. More.

Comments