Tesla’s Bitcoin holdings are surging by riding the crypto wave initiated by Trump winning the US elections.

However, the automaker has yet to start taking Bitcoin payments again.

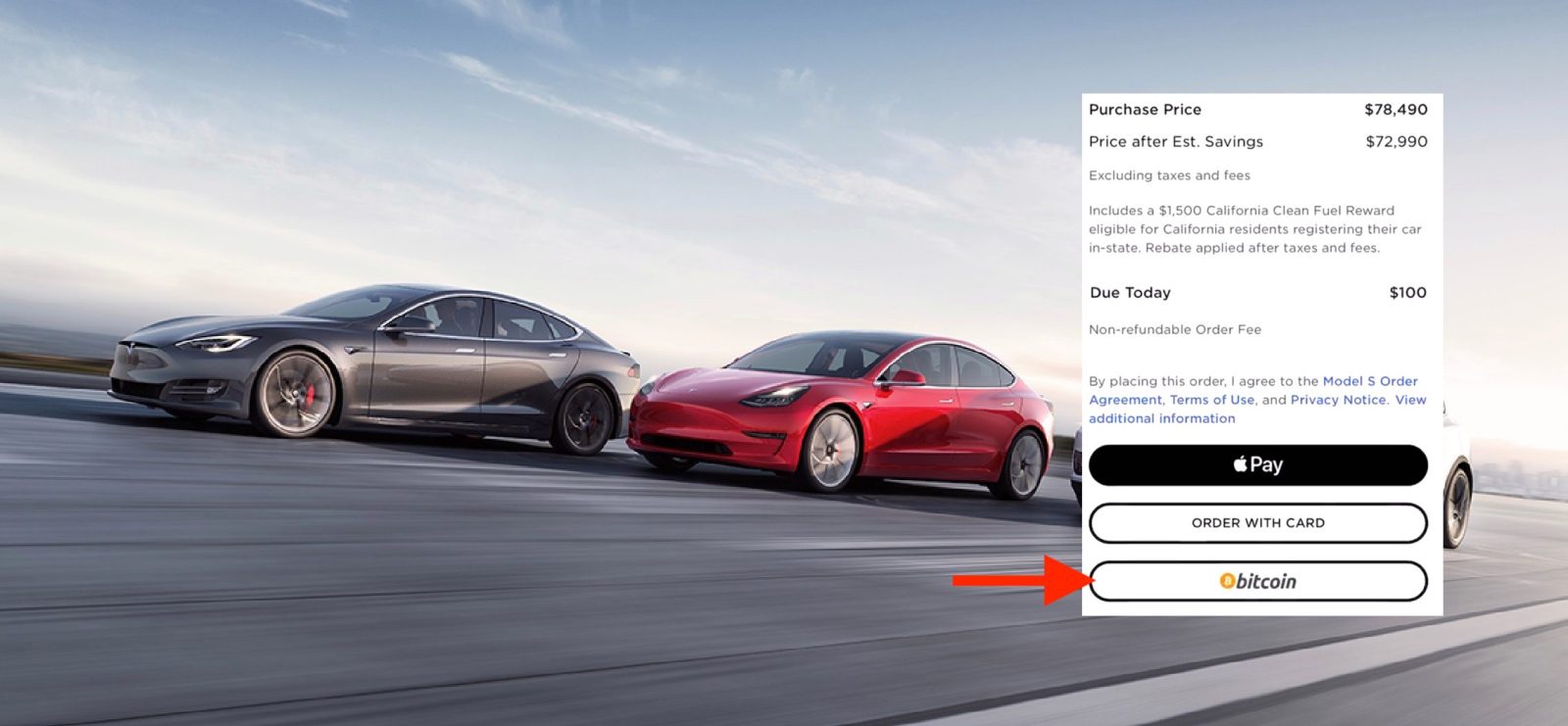

Tesla is one of the few major companies to invest in cryptocurrency. In early 2021, it bought $1.5 billion in Bitcoin and briefly accepted it as payment for vehicles. However, Tesla soon suspended Bitcoin payments due to concerns over fossil fuel use in mining, particularly coal.

The company reassured investors it wouldn’t sell its Bitcoin holdings and would consider resuming payments once the network had a cleaner energy mix. Though Tesla hinted at reopening Bitcoin payments last year, it hasn’t happened yet.

By 2022, Tesla’s Bitcoin holdings had grown to $2 billion but took a hit as the cryptocurrency’s value dropped. Tesla then sold about 75% of its Bitcoin, yielding $1.2 billion, but still holds 9,720 Bitcoins, making it the fourth-largest corporate Bitcoin holder, ahead of Coinbase.

The crypto mostly traded sideways for the last year, but it surged more than 20% since Trump won the election last week.

The market seems to believe that his plans for deregulation will enable cryptocurrencies to grow faster.

It brings Tesla’s bitcoin holdings to over $800 million. It’s unclear if Tesla plans to take profits again like it did during the last surge in pricing.

Lately, there has been a rare development in Tesla’s crypto holdings.

Last month, ahead of the elections, Tesla moved nearly all of its bitcoins into new unknown wallets.

The reason behind the move is unclear at this point.

There were also some indications that Tesla would be preparing to accept Bitcoin payment for its electric vehicles again, but it has yet to happen.

If you are interested in getting into crypto, my two favorite ways are Coinbase and crypto.com. With the latter, you can even spend your crypto through a regular Visa debit card. You can use my referral code (44sqxfg7zh) at crypto.com, and we each get $25 worth of crypto.

FTC: We use income earning auto affiliate links. More.

Comments