Tesla (TSLA) will release its Q4 2024 and full-year 2024 financial results on Wednesday, Jan. 29, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q4 2024 deliveries

While Elon Musk and his loyal shareholders like to say that Tesla is now an AI/Robotics company, the company’s automotive business still drives its financials.

Earlier this month, Tesla disclosed its Q4 2024 vehicle production and deliveries:

| Category | Production (units) | Deliveries (units) | Operating Lease Accounting (%) |

| Model 3/Y | 436,718 | 471,930 | 5 |

| Other Models | 22,727 | 23,640 | 6 |

| Total | 459,445 | 495,570 | 5 |

This quarter, deliveries came significantly deliveries below Wall Street’s expectations.

Now that energy storage is starting to contribute to Tesla’s revenue more meaningfully, the company has also started sharing deployment in its quarterly delivery and production numbers.

This quarter, Tesla confirmed that it deployed 11 GWh of energy storage through its Megapack and Powerall products – a new record.

Tesla Q4 2024 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers, and now the energy storage deployment data.

However, things have been increasingly difficult as Tesla’s average price per vehicle is changing frequently these days due to frequent price cuts and discounts across many markets.

Analysts had to readjust over the last few weeks after Tesla’s deliveries came under their expectations. Now, they also have to account for energy storage, which achieved a new record. Energy storage revenues should achieve a new record, but maybe not as high as some believe because Tesla has cut Megapack prices over the last year.

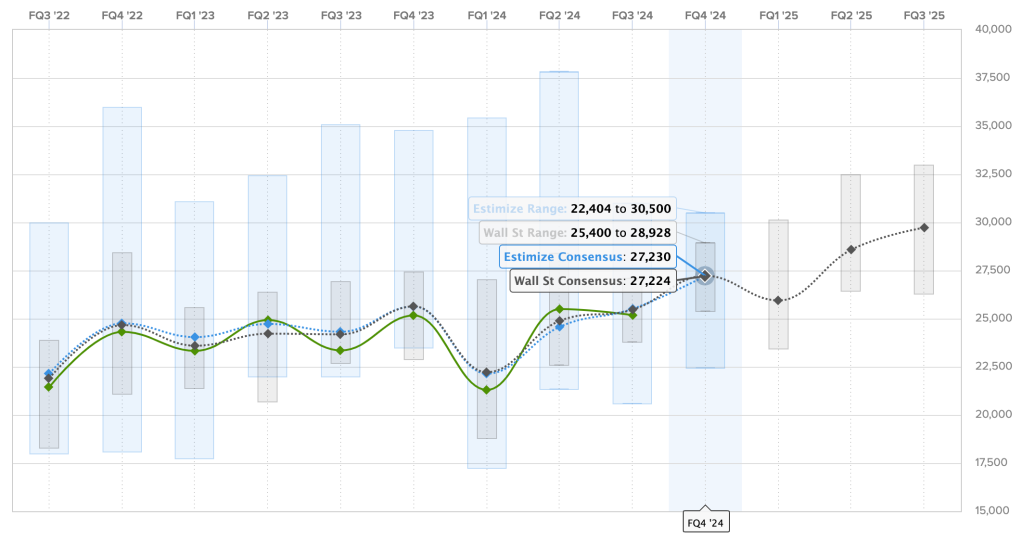

The Wall Street consensus for this quarter is $27.224 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slighty higher revenue of $27.230 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

Last quarter, Tesla missed on revenue, but they are expected to be higher this quarter while the expectations are reasonable.

Tesla Q4 2024 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last three years.

Like revenues, it has been harder to estimate earnings over the last few years, with price cuts and subsidized loans reducing Tesla’s industry-leading gross margins.

Q4 is also often different because Tesla generally accumulates and sell more ZEV credits, which can significantly boost its earnings.

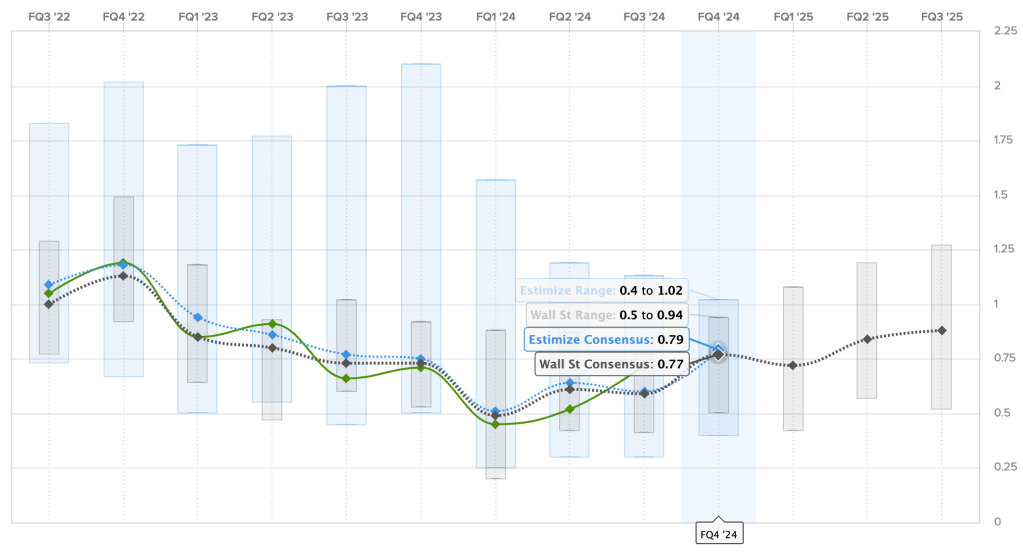

For Q4 2024, the Wall Street consensus is a gain of $0.77 per share and Estimize’s crowdsourced prediction is a little higher at $0.79.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Last quarter, Tesla had a significant beat in EPS compared to expectations due to lower costs, which was surprising because the company had guided higher costs just a few months prior.

Other expectations for the TSLA shareholder’s letter and analyst call

Yesterday, I shared a list of all the most upvoted shareholder questions that are likely to be asked during the conference call following the earnings results.

Top comment by Ethan Hawke

Tesla is a global company, and plenty of US consumers don't care at all about politics, but a lot of us relatively wealthy citizens of the US and EU who have a functioning moral compass are never going to purchase another Tesla product. Doesn't seem like a good business move. They've lost a MY or MX purchase from me this year.

Unsurprisingly, they want to know about the latest unsupervised self-driving timelines and Optimus, which Musk has framed as the programs that will turn Tesla into “the world’s most valuable company.”

I would hope that some shareholders and Wall Street analysts would ask how Musk’s decent into madness is affecting the company, but I don’t want to get my hopes up.

In reality, the main thing that could drive Tesla’s share price up from comments or statements made during the earnings are related to the new cheaper models based on Model 3/Y that Tesla is supposed to launch in the coming months.

They are the only thing right now that can turn Tesla’s automotive business back to growth.

FTC: We use income earning auto affiliate links. More.

Comments