Ford is slashing another 4,000 jobs in Europe as it struggles to keep pace with the market’s shift to electric vehicles (EVs). The American automaker said a “highly disruptive” EV market and new competition are causing significant losses in the region. Ford’s announcement comes as China’s leading EV maker, BYD, is quickly catching up in global deliveries.

Ford is cutting more jobs in Europe amid EV struggles

“Ford has been in Europe for more than 100 years,” the company’s European vice president for Transportation and Partnerships, Dave Johnston, said on Wednesday.

As the market shifts to EVs and new competition arises, Ford is fighting for its share. The company has incurred “significant losses” in recent years amid a “highly disruptive” influx of new EV challengers.

Ford plans to cut another 4,000 jobs in Europe by the end of 2027 as part of its restructuring. The company blamed the “weak economic situation” and “lower-than-expected” demand for electric cars.

The planned cuts will primarily affect Germany, but some will also affect the UK. Ford said in a press release that other European markets will see “minimal reductions. “

Ford is also slowing the output of its new electric Explorer and Capri, both of which were built at its revamped Cologne EV plant in Germany.

Last week, German newspaper Kölner Stadt-Anzeiger (via Automobilwoche) reported that the plant’s employees would be put on short-term work hours. A Ford spokesperson confirmed the move, citing a “rapidly deteriorating” EV market.

Ford confirmed the plans on Wednesday, saying it will result in short-term working days at the Cologne plant in the first quarter of 2025.

An urgent call to action

In a letter to the German government, Ford’s CFO, John Lawler, reiterated the company’s commitment to Europe and the 2035 emissions target. However, he also issued an urgent call to action for all stakeholders to work together to advance the transition. Lawler added:

What we lack in Europe and Germany is an unmistakable, clear policy agenda to advance e-mobility, such as public investments in charging infrastructure, meaningful incentives to help consumers make the shift to electrified vehicles, improving cost competitiveness for manufacturers, and greater flexibility in meeting CO2 compliance targets.

Despite the restructuring, Ford still wants to be a player in Europe. The next generation of Ford vehicles in Europe will be “software-defined” with a “differentiated” design.

The company will focus on its commercial Ford Pro business while competing in select passenger vehicle segments to drive profit growth.

Ford invested $2 billion into its Cologne plant to prepare it for EV production. After the first electric Explorer rolled off the assembly line in June, Ford added its second EV, the new Capri, just last month.

The American automaker has drastically downsized leadership in Germany this year. Earlier this month, Ford lost two of its most experienced leadership team members. It’s now down to two directors from nine earlier this year.

Electrek’s Take

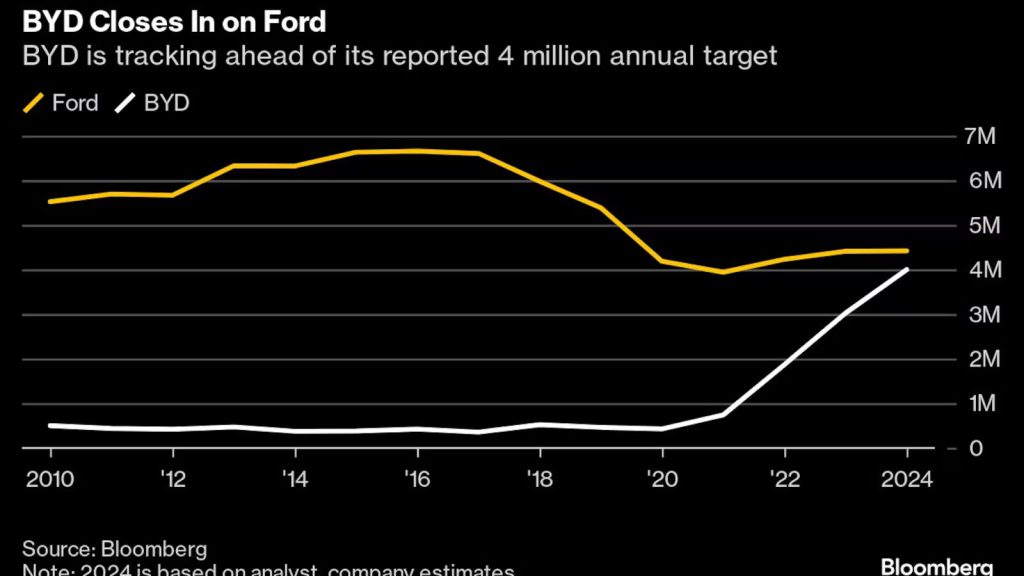

Ford’s restructuring in Europe comes as EV leaders, like China’s BYD, continue gaining ground in the global auto market.

After dominating its home market, BYD and other Chinese EV makers are looking overseas to drive growth.

BYD is already a leading EV brand in key regions like Southeast Asia and Central and South America, but it expects sales to accelerate in the next few months. The EV giant opened its first manufacturing plant in Thailand earlier this year, and more are planned for Hungary, Brazil, Mexico, Pakistan, and Turkey.

According to Bloomberg, BYD is rapidly approaching Ford in global deliveries. Although BYD is best known for its low-cost EVs, like the Seagull, which starts at under $10,000 (69,800 yuan) in China, it’s quickly expanding into new segments like pickup trucks, mid-size SUVs, and luxury models.

Ford’s CEO Jim Farley warned rivals earlier this year that if they fail to keep up with the Chinese, “20% to 30% of your revenue is at risk.”

Top comment by Martin

That statement by Mr. Lawler Is pure delusional. Charging infrastructure in Europe is fine. Ford's strategy was simply wrong. Cars like Focus and Fiesta have been absolute institutions, but Ford changed strategy and want to sell big and expansive cars in Europe, too. That failed.

“As the CEO of a company that had trouble competing with the Japanese and the South Koreans, we have to fix this problem,” Farley said.

While Ford’s Model e EV unit is on track to lose between $5 billion and $5.5 billion this year, BYD just reported a record $1.6 billion (RMB 11.6 billion) in Q3 net income amid surging EV sales. October was BYD’s eighth straight record sales month, with over 500,000 passenger vehicles sold for the first time.

Ford is betting on smaller, more affordable EVs to turn things around with its new low-cost platform. The first EV model powered by the platform, a new electric truck, is due out in 2027.

Can Ford turn things around? Or will it be too little too late? Let us know your thoughts in the comments below.

FTC: We use income earning auto affiliate links. More.

Comments