Tesla’s stock (TSLA) is up this morning on delivery data from China showing a strong end-of-quarter performance, but is this enough to save its Q3?

Insurance registration data in China shows that Tesla delivered 15,600 vehicles in the country last week, down 3.7% from the prior week, which had a strong performance with 16,200 registrations.

This is a strong start for September, with 31,800 registrations. That only accounts for Tesla’s vehicles built at Gigafactory Shanghai and sold domestically—though that’s generally most of its Shanghai production at the end of quarters to limit vehicles in transit.

Tesla tends to end quarters strong with a push in deliveries over the last few weeks.

According to the China Passenger Car Association (CPCA), Tesla China delivered 86,697 electric vehicles made in China in August and just over 74,000 vehicles in July.

Tesla is on pace to deliver over 230,000 electric vehicles in and from China in Q3.

Is China going to save Tesla’s Q3?

Tesla introduced 0% financing in China this year in order to boost demand in its most important market and it is clearly working.

However, other markets are not doing as well.

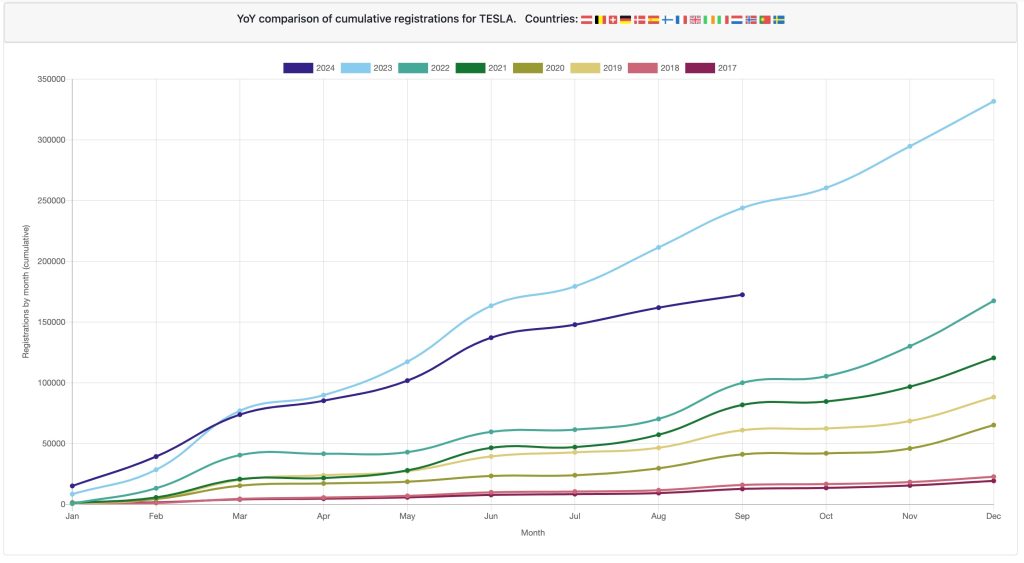

According to registration data, Tesla’s deliveries in Europe are way down this year:

Tesla is down more than 70,000 vehicles in its biggest EU markets compared to last year. The difference is more significant by 10,000 units since we last checked in August.

Electrek’s Take

It looks like China is going to be able to compensate for some of Tesla’s troubles in the EU, but not all of it.

The difference maker in Q3 could end up being the US market, where Tesla has been having its own issues, but it recently introduced strong incentives to try to boost sales.

The new referral program basically results in a $1,000 discounts on all cars except Cybertruck. Speaking of Cybertruck, it’s not a high volume program, but the recent ramp-up in production does point to it contributing a few tens of thousands of units to Tesla’s total deliveries in Q3.

Top comment by Grant

Let's address the elephant in the room. Tesla will continue to have lower and lower profit margins due to competition. I think they will survive, but the golden age of being the first major player into an emerging market is over.

Finally, Tesla recently introduced new financing incentives in the US that are likely going to be impactful at the end of the quarter.

At this point, I think Tesla is likely going to beat deliveries from last quarter, 443,956 units, which would actually mean a return to year-over-year growth for Tesla since it delivered 435,000 units during the same period in 2023.

However, I believe that Tesla will be far short of the 585,000 vehicles it needs to be deliver in order to be on pace for its original goal of 2 million deliveries in 2024. It might even be short of the 485,000 vehicles it needs to be on pace so as not to be down year-over-year in deliveries for the whole year.

What do you think? Let us know in the comment section below.

FTC: We use income earning auto affiliate links. More.

Comments