Tesla (TSLA) is about to release Q3 2022 financial results on Wednesday, October 19, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here we’ll take a look at what both the street and retail investors are expecting for the quarterly results.

Tesla Q3 2022 deliveries

As usual, Tesla already disclosed its Q3 vehicle delivery and production numbers, which drives the vast majority of the company’s revenue.

Earlier this month, Tesla confirmed that it delivered just over 343,000 electric vehicles during the third quarter of the year.

This is a delivery record for Tesla, but the automaker actually came in under expectations because it had over 20,000 vehicles in transit at the end of the quarter.

Delivery and production numbers are always slightly adjusted during earning results.

Tesla Q3 2022 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers.

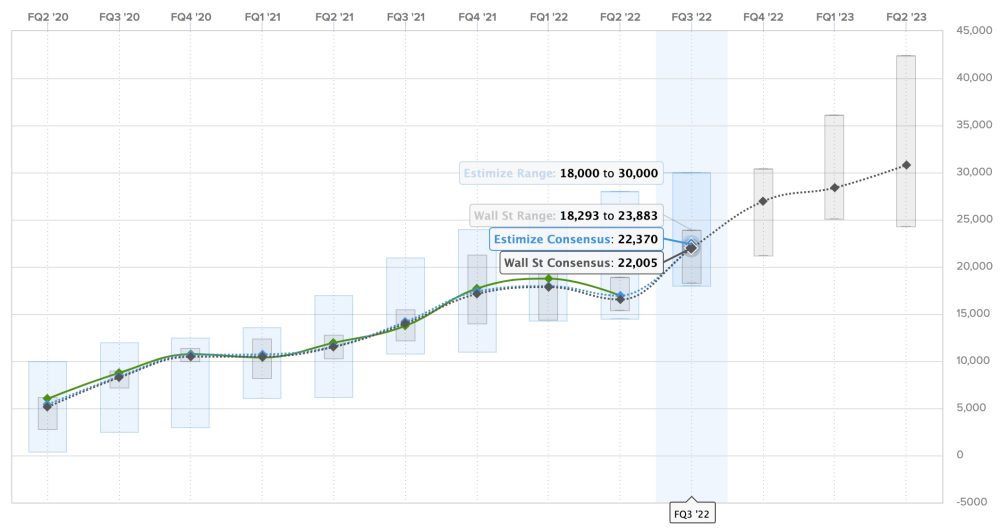

The Wall Street consensus for this quarter is $22.005 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $22.370 billion.

This would be a record quarter for revenue, thanks to the record deliveries.

Here are the predictions for Tesla’s revenue over the past two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Tesla Q3 2022 Earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last two years now.

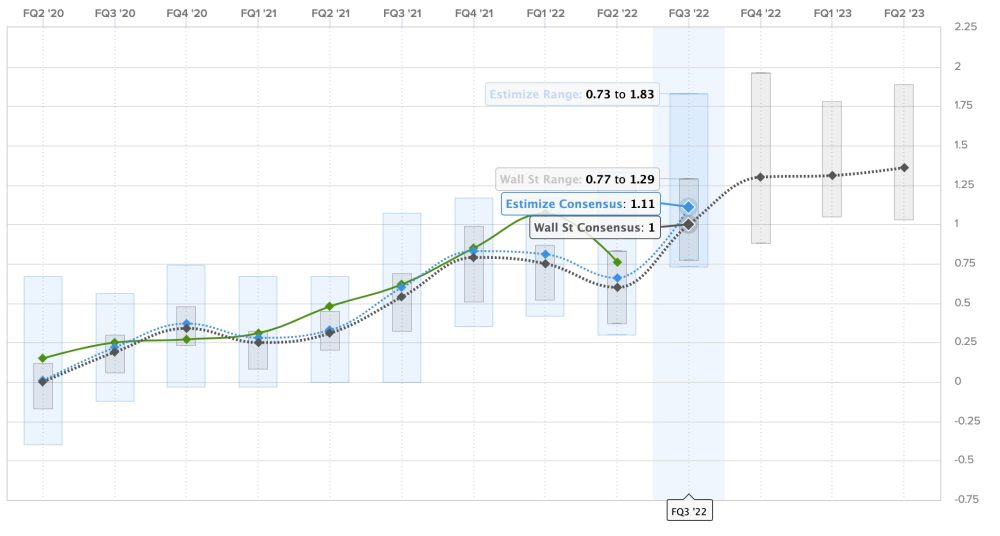

For Q3 2022, the Wall Street consensus is a gain of $1.00 per share, while Estimize’s prediction is higher with a profit of $1.11 per share.

It’s going to be harder to determine earnings this quarter due to the over 20,000 vehicles in transit at the end of the quarter, which is going to negatively affect Tesla’s results. Analysts are still expecting positive earnings, but Tesla is going to be lower than it would have with fewer vehicles in inventory.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Other expectations for the TSLA shareholder’s letter and analyst call

In the shareholder’s letter and the following conference call, Tesla generally shares additional details about not only financial results but also other important metrics on how the company is doing.

CEO Elon Musk is not always on the call, but this time, he confirmed that he will be on it.

Every company is reporting earnings these days with economic uncertainty in the background.

Musk is expected to address that, in addition to how he plans for Tesla to get through a potentially rougher time at the macroeconomic level.

Furthermore, Tesla investors are likely going to want Musk to explain his plan around Twitter since he has now finally agreed to buy it. Managing the social media platform could potentially take a lot of his time away from Tesla.

On the operational front, Tesla shareholders are also going to be looking for an update on the production ramps at Gigafactory Texas and Gigafactory Berlin.

An update on Tesla Semi could also come with the earnings results since Musk has announced that production started and deliveries are expected to start in December.

Electrek previously reported that Tesla had set up a production capacity of five trucks per week at its facility in Nevada, but that might have changed since last year.

FTC: We use income earning auto affiliate links. More.

Comments